November Preview Report

Jesse DivnichDecember 10, 2007

Key Points

- Video games to break record sales

- PC Games continue to cannibalize each other

- Assassin's Creed - the woes of new intellectual property

- Rock Band - Too many hands in the cookie jar

- Wii - Can it handle M-rated titles

This report is intended to aid industry professionals and the press in drawing insight and discovering trends occurring in the video game industry through the use of the simExchange video game prediction market (www.thesimexchange.com), a data aggregation system in which gamers, developers, and industry investors trade virtual video game stocks and futures to predict how video game products will sell and how they will be critically received.

Results based on NPD data have consistently shown that The simExchange prediction market can predict results not only more accurately than traditional models and surveys, but also more quickly adjust forecasts based on industry and product news.

The simExchange's Market Predictions

-

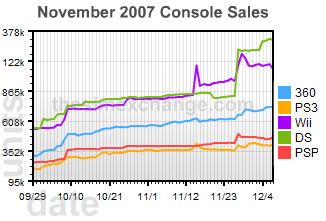

US Hardware in November 2007

Title Predicted unit sales Xbox 360 728,000 units PLAYSTATION 3 410,000 units Wii 1,060,000 units Nintendo DS 1,300,000 units PlayStation Portable 468,000 units

-

US Software in November 2007

Title Predicted unit sales Assassin's Creed (PS3) 272,000 units Call of Duty 4: Modern Warfare (Xbox 360) 833,000 units Crysis (PC) 66,000 units Manhunt 2 (Wii) 46,000 units Mario & Sonic at the Olympic Games (Wii) 242,000 units Mass Effect (Xbox 360) 328,000 units Rock Band (Xbox 360) 152,000 units Super Mario Galaxy (Wii) 1,270,000 units Unreal Tournament 3 (PC) 78,000 units Hardware Sales

Continuing the trend over the last 6 months, the Wii is expected top the console charts with 1,060,000 units according to the trading on the prediction market. The Xbox 360, a close second, is forecast to sell 728,000 units, while at a distant third, again, is the PS3 at 410,000 units. On the portable side, the trend persists with the Nintendo DS selling 1,300,000 units and the PSP selling 468,000 units, according to the prediction market.

Consistently a distant third, the PS3 is beginning to close the gap with its closest rival, as the Xbox 360 is only expected to out sell the PS3 1.8-to-1 in November compared in to 3-to-1 in October. The prediction market upgraded the PS3 forecast after the initial reception of the new 40GB PS3 model and recent press releases indicating a strong Thanksgiving weekend.

Despite increasing PS3 sales, we do not expect any significant shift in PS3 market share in Sony’s favor until mid 2008. A shift will likely be the result of continued hardware price cuts and the release of several AAA titles such as Metal Gear Solid 4 and Grand Theft Auto IV—both of which is expected to be released near the half-way point of 2008. The PS3 is expected to gain market share as the prediction market is still expecting a close race in global lifetime sales with current expectations of 58 million units and 54 million units for the Xbox 360 and the PS3, respectively.

Record Software Sales

The prediction market expects November’s software sales to be $1.15 billion which is a 42% increase over sales last year. These sales were driven by the continued success of Guitar Hero 3, Halo 3, and Zelda: Phantom Hourglass along with newly released titles such as Assassin’s Creed, Call of Duty 4, Mass Effect, Need for Speed, Super Mario Galaxy, and WWE Smackdown vs. Raw 2008. The prediction market’s forecast on software sales will be the highest ever seen in the month of November and the first time November sales will break $1 billion.

Not to be outdone, December sales are expected by the prediction market to ring in $2.39 billion, which is a 38% increase year-over-year, another record-breaking month. Combining The NPD Group’s estimates in October, retailers will net over $4.04 billion in software sales this holiday quarter, a 39% increase year-over-year—a record as well.

Although consumer spending has slowed down this quarter with many retailers reporting disappointing results, video games are largely inelastic to consumer income. The market’s forecast for November and December confirms the belief that video games are a safe haven business in slower consumer spending environments.

PC Games – Continued Cannibalization

PC games have long been considered the pioneer in industry gaming, always pushing the envelope in graphics and online play. Unfortunately, this year has seen a slew of highly anticipated first-person shooter titles packed into the back half of the year. This resulted in sales cannibalization as witnessed last month by poor sales of Enemy Territory: Quake Wars due to competition from Half-Life 2, and anticipation for Call of Duty 4, Crysis, and Unreal Tournament 3.

A similar phenomenon is occurring in November. The prediction market is only expecting 66,000 units and 78,000 units sold for Crysis and Unreal Tournament 3, respectively. The prediction market likely expects Unreal Tournament 3 to outsell Crysis due to Crysis’ high hardware requirements. In terms of PC game sales, superior game play still remains the strongest lure to consumers; consequently, high powered graphics play an adverse role on PC games sales. Counter-Strike, Everquest, World of Warcraft, and the recent Half-Life 2: Orange Box are examples of this decades biggest PC titles which, achieved worldwide success due to their compelling game play and low hardware requirements.

Conversely, Crysis was more popular among web users as it achieved a higher “average daily gamers” metrics in November on IGN GamerMetrics*: 24,588 to Unreal Tournament 3’s 17,633. Although gamers enjoyed viewing the videos and screenshots Crysis had to offer, the prediction market’s projections suggest that few had the hardware power to purchase Crysis. For reference, the game with the highest “average daily gamers” metric on IGN GamerMetrics for November was Mass Effect with an average of over 64,000 daily visits.

* Data used with express written consent by IGN GamerMetrics.

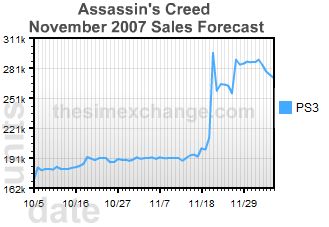

Assassin's Creed – The woes of a new Intellectual Property

The prediction market has been expecting Ubisoft's Assassins Creed to be one of the highest anticipated titles of the year. A month before the game’s release, the prediction market expected the PS3 version of Assassin's Creed to sell in the 200,000 unit range. These relatively low expectations for such a highly anticipated title were likely due to concerns with the game’s quality as critics and bloggers released mixed previews. This trend persisted through the first week of release as reviewers poured mixed reviews to consumers.

Sales expectations began to rise as Ubisoft kicked up its marketing efforts online, in print, and on television, resulting in a large increase in projected sales to the current estimate of 272,00 0 unit for the PS3 version. These projections are reinforced by data available from GameTrailers.com*, which tracks “Media Views” a metric for the number of visitors that view a Publisher-produced or GameTrailers-produced video.

Between November 11, 2007 and December 2, 2007, Assassin’s Creed received 3,029,950 Media Views—the highest score for any game during that time period. Just for comparison, the second ranked title was Mass Effect at only 1,490,606 Media Views.

Despite mixed reviews, Assassin’s Creed was able to penetrate the mainstream market by delivering an effective but costly marketing campaign. This is common as large marketing budgets are often needed to jump-start new properties as brand awareness and market credibility are low. This is often risky for publishers as they bear all the risk by sinking funds into a marketing budget for an un-established title. This is why publishers prefer sequels and recycled yearly titles as marketing an established game have fewer costs.

* Data used with express written consent by GameTrailers.com

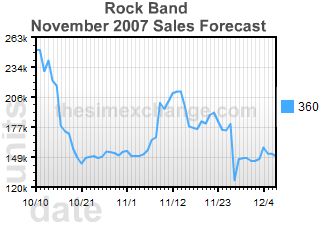

Rock Band – Too many hands in the cookie jar

Rock Band is a great example of what can go wrong when too many people are involved in marketing a product. The poor execution and communication has made this the most volatile NPD Future in November. Originally, the prediction market expected Rock Band to sell over 200,000 units in November, but that forecast quickly dropped to 145,00 units as news broke that a $169 bundle would be the only version available for 2007. Days later, Harmonix reversed Electronic Arts’ statement and announced that an unbundled version will be available in 2007. This reversal lead to an upgraded forecast by the prediction market.

Price swings continued as Electronic Arts announced Rock Band would be in short supply, a tactic often used by hardware manufacturers to pump up demand. The market than slowly cut forecasts after the game’s release as bloggers commented that not only was retail supply plentiful, but consumers were having problems with third-party guitars. The current projection for November is 152,000 units for the Xbox 360.

Prediction markets are most commonly used as a tool for forecasting, but they can also enable us to track the public’s perception of a game’s business strategies in terms of marketing, advertising, and public relations. Rock Band is an example of what can happen when three different companies (Harmonix, MTV, and Electronic Arts) attempt to simultaneously market the same product.

Manhunt 2 – Can the Wii Handle “M” and Can American Publishers Succeed

American publishers and Nintendo have had a bumpy relationship over the last few years as American publishers have continued to fail to gain any traction on Nintendo’s consoles. This was prevalent on the legacy system Nintendo Gamecube, but was never considered a serious issue by investors as the Gamecube’s market share was not significant. This generation, Nintendo has turned the tides as it now dominates both the home console and the handheld market.

The increasing significance of Nintendo platforms is a growing concern as American publishers have had little success on the Nintendo Wii in 2007; the exception to that rule would be Activision’s Guitar Hero III. Manhunt 2 for the Wii could serve as a significant example for the future success of not only “M” rated games on the Wii but how well American publishers are taking advantage of the Wii’s vast consumer base.

Originally, the prediction market expected Manhunt 2 sales to surpass 120,000 units, but as the release date for the game approached, the prediction market began pricing in Manhunt 2’s quality pitfalls. the game’s currently expected sales of 46,000 units for November is far below the market’s original expectation. The problems with the Manhunt 2 appear to be specific to the title and not the Wii market and so it should not be considered as any type of barometer for how an M-rated game can succeed on the Nintendo Wii. It has been said in the past that Wii consumers prefer originality over conformity, innovation over similarity, and more importantly, titles that are just simply fun to play. Manhunt 2 is innovative and its control scheme keeps it original; however, it just lacks one crucial element—it’s not fun.

Publishers, Retailers, and Investors

Contact us below to find out how you can stay ahead of the competition by using some of our Industry Services.

Interview Requests

Both Jesse Divnich and Brian Shiau are available for interviews and direct comments from the media or the investment community. Please see this reports footnote for their contact information.

Media

This report and all forecasts on the simExchange Web site are available for your use. Please provide your readers context on the nature of these forecasts, for example: "The simExchange is an online virtual stock market in gamers, developers, and investors trade stock to predict how games will sell."

Jesse and Brian will offer quotes and/or analysis for your articles or any current event pertaining to the video game industry upon request. Any request should be made using the Contact Us form.

About The simExchange

The simExchange (www.thesimexchange.com) is the online prediction market for video games. Launched in November 2006, The simExchange allows thousands of gamers, developers, and industry watchers to forecast the video game industry. Participating in The simExchange is completely free and no real money is involved.

About Jesse Divnich

Jesse Divnich has been working in the video game industry for over 10 years. During that time he has assumed many professional roles including: beta tester, programmer, publisher analyst, and for the last 6 years, a private analyst and consultant for buy-side investment firms. Jesse Divnich has received many awards for his work in the private investment sector as an analyst covering publicly traded video game companies. Currently, Jesse Divnich has switched from the private sector to the public sector as an Analyst for The simExchange where he writes analytical articles on various industry topics.

Copyright and reprinting

The simExchange, LLC retains the right to the content of this article but permits the reprinting of this article with proper credit to The simExchange and Jesse Divnich.

The simExchange, LLC does not issue any investment ratings or investment recommendations for any publicly traded company. The accuracy of the opinions or data in this report is not a guarantee.

Permanent Link | Digg | del.icio.us | Facebook

About Us - The simExchange is the video game stock market and the source for video game sales forecasts.

November hardware sales

Console Prediction Today's Change Xbox 360 836K units 0.00% PS3 378K units 0.00% Wii 2.04M units 0.00% Nintendo DS 1.57M units 0.00% PSP 421K units 0.00% November software sales

Title Prediction Today's Change Call of Duty: World at War (Xbox 360) 1.41M copies 0.00% Call of Duty: World at War (PS3) 597K copies 0.00% Gears of War 2 (Xbox 360) 1.56M copies 0.00% Resistance: Fall of Man 2 (PS3) 385K copies 0.00% Total Software Sales () 1.45M copies 0.00% Wii Play (Wii) 796K copies 0.00% Subscribe research via email

Subscribers will receive reports before they are posted here.

Please use your company email address.

The Feed

Add the Research Feed

Add the Research Feed

-