January 2008 Preview Report

Jesse DivnichFebruary 11, 2008

Key Points

- Total Software Sales

- Hardware sales

- Mario marches past Call of Duty 4

- Burnout Paradise Finishes Strong

- A Few Heroes

- Sonic Flops without Mario

This report is intended to aid industry professionals and the press in drawing insight and discovering trends occurring in the video game industry through the use of the simExchange video game prediction market (www.thesimexchange.com), a data aggregation system in which gamers, developers, and industry investors trade virtual video game stocks and futures to predict how video game products will sell and how they will be critically received.

The simExchange's Market Predictions

-

US Hardware in January 2008

Title Predicted unit sales Xbox 360 289,000 units PLAYSTATION 3 200,000 units Wii 403,000 units Nintendo DS 460,000 units PlayStation Portable 250,000 units

-

US Software in January 2008

Title Predicted unit sales Advance Wars: Days of Ruin (DS) 101,000 units Burnout Paradise (PS3) 107,000 units Call of Duty 4: Modern Warfare (Xbox 360) 336,000 units Guitar Hero III: Legends of Rock (Wii) 180,000 units Kingdom Under Fire: Circle of Doom (Xbox 360) 84,000 units Mario & Sonic at the Olympic Games (DS) 149,000 units Rock Band (Xbox 360) 196,000 units Sonic Riders: Zero Gravity (Wii) 99,000 units Super Mario Galaxy (Wii) 378,000 units

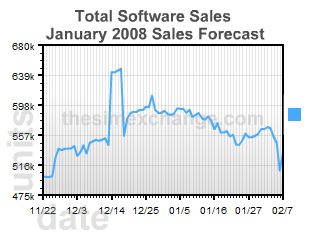

Total software sales are expected to ring in at $519 million, a -5.46% change compared to last year. It should be noted that January 2007 consisted of 5 weeks compared to January 2008, which only consisted of 4 weeks of retail sales. Adding in a 5th week to January 2008 would have likely resulted in retail sales of $648 million, an 18% increase over last year.

January 2008 sales were driven strongly by the continued success of Super Mario Galaxy, Wii Play, Guitar Hero, Call of Duty 4, and Rock Band. January’s new releases also played a significant role in driving sales, specifically Electronic Art's Burnout Paradise, Nintendo’s Advanced Wars: Days of Ruin, and Sega’s Mario & Sonic at the Olympic Games (DS).

For January, the prediction market expects Nintendo to conquer again in terms of hardware sales with the Wii and the DS taking the top spot in both the home and portable categories at 403,000 units and 460,000 units, respectively. Furthermore on the home console side, the Xbox 360 is expected to take the runner-up spot at 289,000 units and the PS3 to place third again at 200,000 units.

Although there were no momentous changes in hardware trends, it should be noted that the Xbox 360 is expected to outsell the PS3 by 1.44 to 1, a decrease from November’s 1.65 to 1 and December’s 1.58 to 1. We consider this noteworthy as neither system had any superior exclusive releases or price drops in January and could be an early sign of the PS3 gathering momentum on the Xbox 360.

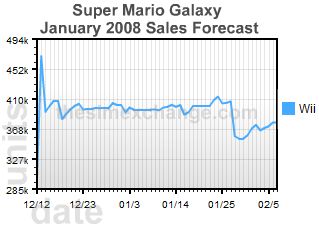

Mario marches past Call of Duty 4

According to the prediction market, January’s top selling SKU will be Super Mario Galaxy for the Nintendo Wii at 378,000 units. This would dethrone Call of Duty 4 for the Xbox 360, which led the November and December charts as the top selling SKU.

Long-term, the prediction market expects Super Mario Galaxy to outsell the Xbox 360 version of Call of Duty 4 in Global Lifetime Sales (GLS): 13.46 million to 7.66 million units. However, these figures may be miss-leading in implying the greater success of Super Mario Galaxy as the prediction market expects a 12% market penetration for Call of Duty 4 (Xbox 360) compared to Super Mario Galaxy (Wii)’s 11% market penetration. For reference, the prediction market expects 60 million units in GLS for the Xbox 360 and 122 million units in GLS for the Wii.

Burnout Paradise Finishes Strong

Electronic Arts had a rough 2007 holiday season with the majority of its yearly titles performing below market expectations; however, Burnout Paradise has started a new year to positive reception. For January, the prediction market expects over 107,000 units sold for the PS3 version.

Although the simExchange did not list an NPD Future for the Xbox 360 version, we can estimate its sales by applying the ratio between the GLS stocks of both versions, which compares 1.92 million to 1.36 million (1.41 to 1) for the Xbox 360 and the PS3, respectively. This would project that the Xbox 360 version likely sold 151,000 units in January, for a monthly total of 258,000 units for both SKUs. These expectations will likely make Burnout Paradise the number one selling new release in January.

The simExchange did not list Ubisoft’s No More Heroes as a January NPD Future; however, the game is tracked for its second month of sales in February. The simExchange also lists a GLS stock, which is forecasting an underwhelming 712,000 units for GLS. This comes as a disappointment as it has long been assumed that the Nintendo Wii’s low software tie in ratio was due to lackluster third-party releases. Currently, No More Heroes holds the 4th highest Wii Metacritic score at 83 and despite its superior gameplay, it is clear that there still remain hurdles on the Wii for not only third-party publishers, but for titles that attempt to target the core gaming audience.

"No More Heroes (NMH) is a step in the right direction for the Wii platform. Even though sales may not be stellar compared to what the game probably could have garnered on a different console it is important for game developers to begin to create games for the Wii that are more immersive. For the Wii to continue to have strong sales and not get cornered into a party game system it must prove it can sustain titles that appeal to a more hard core audience. NMH is an important attempt at helping the Wii reaches its full potential."

Ben Bajarin – Creative Strategies

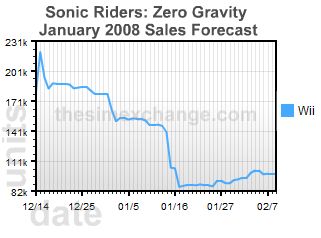

Sega and the Sonic franchise achieved great success in December 2007 by teaming up with the Mario brand for "Mario & Sonic at the Olympics" for the Wii, which ranked #10 in overall unit sales in December at 613,000 units.

Hoping to continue the momentum, Sega released a follow-up Sonic game on the Wii titled Sonic Riders: Zero Gravity. Despite strong momentum in December, the prediction market began downgrading the title as review scores came in under expectations. Currently, the prediction market expects 99,000 units in January and Metacritic ranks Sonic Riders: Zero Gravity with an aggregated review score of 58 out of 100—definitely underwhelming.

Publishers, Retailers, and Investors

Contact us below to find out how you can stay ahead of the competition by using some of our Industry Services.

Interview Requests

Both Jesse Divnich and Brian Shiau are available for interviews and direct comments from the media or the investment community. Please see this reports footnote for their contact information.

Media

This report and all forecasts on the simExchange Web site are available for your use. Please provide your readers context on the nature of these forecasts, for example: "The simExchange is an online virtual stock market in gamers, developers, and investors trade stock to predict how games will sell."

Jesse and Brian will offer quotes and/or analysis for your articles or any current event pertaining to the video game industry upon request. Any request should be made using the Contact Us form.

About The simExchange

The simExchange (www.thesimexchange.com) is the online prediction market for video games. Launched in November 2006, The simExchange allows thousands of gamers, developers, and industry watchers to forecast the video game industry. Participating in The simExchange is completely free and no real money is involved.

About Jesse Divnich

Jesse Divnich has been working in the video game industry for over 10 years. During that time he has assumed many professional roles including: beta tester, programmer, publisher analyst, and for the last 6 years, a private analyst and consultant for buy-side investment firms. Jesse Divnich has received many awards for his work in the private investment sector as an analyst covering publicly traded video game companies. Currently, Jesse Divnich has switched from the private sector to the public sector as an Analyst for The simExchange where he writes analytical articles on various industry topics.

Copyright and reprinting

The simExchange, LLC retains the right to the content of this article but permits the reprinting of this article with proper credit to The simExchange and Jesse Divnich.

The simExchange, LLC does not issue any investment ratings or investment recommendations for any publicly traded company. The accuracy of the opinions or data in this report is not a guarantee.

Permanent Link | Digg | del.icio.us | Facebook

About Us - The simExchange is the video game stock market and the source for video game sales forecasts.

November hardware sales

Console Prediction Today's Change Xbox 360 836K units 0.00% PS3 378K units 0.00% Wii 2.04M units 0.00% Nintendo DS 1.57M units 0.00% PSP 421K units 0.00% November software sales

Title Prediction Today's Change Call of Duty: World at War (Xbox 360) 1.41M copies 0.00% Call of Duty: World at War (PS3) 597K copies 0.00% Gears of War 2 (Xbox 360) 1.56M copies 0.00% Resistance: Fall of Man 2 (PS3) 385K copies 0.00% Total Software Sales () 1.45M copies 0.00% Wii Play (Wii) 796K copies 0.00% Subscribe research via email

Subscribers will receive reports before they are posted here.

Please use your company email address.

The Feed

Add the Research Feed

Add the Research Feed

-