Industry Review

Jesse DivnichJanuary 9, 2008

Key Points

- Industry Sales and GameStop Inc.

- Casual Gamers Taking Over

- American Publishers Struggle with Casual Games

- Spreading out AAA titles in 2008

- Price Points to Stay at a Premium

Introduction

This report is intended to aid industry professionals and the press in drawing insight and discovering trends occurring in the video game industry through the use of the simExchange video game prediction market (www.thesimexchange.com), a data aggregation system in which gamers, developers, and industry investors trade virtual video game stocks and futures to predict how video game products will sell and how they will be critically received.

Industry Sales and GameStop Inc.

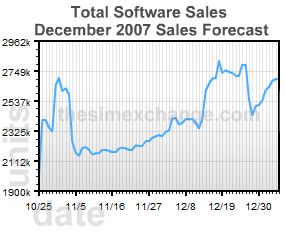

Considering the prediction market's expectations for December software sales at $2.7 billion and past software sales numbers from the NPD Group for October and November, Fourth Quarter 2007 video game software sales are expected to ring in over $4.5 billion, a 55% increase over last year's $2.9 billion—an industry record.

Given this huge year-over-year increase, retailer GameStop is likely to shatter their own original internal estimate of only a 7% to 9% increase in comparable same store sales for their Fiscal Fourth Quarter (GameStop Inc. Form 8-k 11/20/2007). It should be noted that GameStop's FY Q4 runs from November 4 to February 3. Filling in those gaps with the prediction market's expectation of $592 million in sales for January, total video game software sales from November through January are expected to be $4.5 billion, a 49% increase over last year's $3.1 billion.

Retailers in general have had a rough holiday season with most posting dismal holiday figures, but given the explosive growth in the video game industry, we can expect GameStop to be one of the very few retailers to post flourishing figures this season.

One catalyst that played a factor for the industry's explosive growth is a larger than expected next generation adoption rate among casual gamers; unfortunately, this same catalyst has played only a minor role for GameStop stores.

Casual Gamers

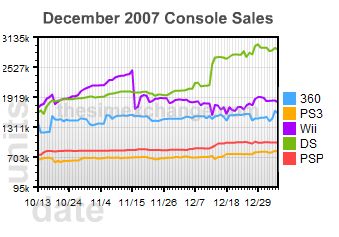

Typically, casual gamers are the last group to purchase the next generation console systems as they prefer to wait for lower hardware prices before making an entry. This generation has broke the trend as casual gamers flocked to purchase the Nintendo Wii and Nintendo DS, which have positioned themselves in the market as the systems of choice among families, parents, seniors, and the other demographic groups that do not consider themselves avid gamers. Confirmation of this is observed in December 2007 sales as the Nintendo Wii is expected to sell over 1.8 million units and the DS to sell over 2.9 million units. Interesting enough, the DS selling over 2.9 million units would be an industry record for consoles or portables sold in one month. The current record is held by the PS2 at 2.6 million units in December 2002.

This influx in casual gamers can also be observed by the recent greater than expected performance of casual titles such as, Guitar Hero 3, Brain Age 2, and Wii Play, all of which are expected to exceed 9 million units in global lifetime sales (GLS), according to the prediction market. Even the upcoming Wii Fit is expected to achieve 8.73 million in GLS, putting it in same category as mega blockbusters as Halo 3 and PS3's Final Fantasy XIII, which are expected to achieve 9.1 and 7.8 million units in GLS, respectively. This rapid adoption rate among casual gamers is expected to continue in 2008 as hardware prices are reduced and video game companies expand their advertising campaigns to non-conventional media markets such as: television shows that target an older and female audience, family programming, and ironically, health magazines.

Based on the trends observed on the simExchange, we consider the casual market to be GameStop's biggest opportunity as the gap between their comparable store sales growth and that of the industry's total software sales growth is likely due to their lack of market penetration into casual/family sector.

"I agree with your assessment that GameStop has been a buying stop for more hard core gamers. I also think that their store environment is not inviting and is intimidating for the typical buyer of casual games, like mothers, non gamers etc. Another factor may be their inability to keep the popular games in stock. More casual buyers who shop at Wal-Mart, Target, Best Buy etc understand that those retail outlets carry larger volumes so there is a good chance a popular game will be in stock."

Ben Bajarin – Creative Stategies

American Publishers Struggle with Casual Games

By nature, casual games have a shorter development time, which lowers development costs and increases profit margins. To substantiate this, Guitar Hero had 3 releases and one add-on pack in the same timeframe it took Infinity Ward to produce and release one Call of Duty title (Call of Duty 4: Modern Warfare). To demonstrate the magnitude of the success of the Guitar Hero franchise, to date it has sold over 9.5 million units in the United States (data provided by The NPD Group). Guitar Hero 3 alone is expected by the simExchange to sell 8.2 million units in GLS; Call of Duty 4, 7.5 million in GLS.

Although publishers such as Nintendo have had tremendous success with this genre, it is a different story for the American publishers whose successes in the genre in recent years consist of two main franchises, The Sims and Guitar Hero. It is lucid that the American publishers have had a difficult time tapping into the casual and family market. What has made it difficult is their lack of understanding of the casual and family market, something Nintendo has clearly mastered. The prediction market supports this as the top 5 titles for both the Wii and the DS consist of 9 Nintendo published titles and no American published titles.

-

Nintendo DS

Rank Title Expected units 1 Pokemon Diamond / Pearl (DS) 17.13 million 2 Brain Age 2 9.2 million 3 Dragon Quest IX (DS) 6.71 million 4 The Legend of Zelda: Phantom Hourglass 4.27 million 5 Mario Party DS 3.04 million

-

Nintendo Wii

Rank Title Expected units 1 Wii Play (Wii) 14.21 million 2 Super Smash Bros Brawl (Wii) 13.95 million 3 Mario Kart (Wii) 13.16 million 4 Super Mario Galaxy (Wii) 12.61 million 5 Wii Fit (Wii) 8.73 million Although the American publishers will still experience growth as the core gaming market grows, penetrating the casual market will provide the largest growth. To be successful, the American publishers must venture beyond the status quo of game design and start exploring these unconventional genres--something Nintendo has had astonishing success.

"Publisher's were largely caught off-guard by the runaway success of the Wii. As a result they are late to the table with developing titles, choosing to port PS2 titles, and thus make measuring their performance difficult. The more challenging aspect for publishers will be adapting their development teams and franchises to be better suited to the platform."

Dave Moreno - NeoGAF LLC.

Spreading out AAA titles in 2008

Hardcore gamers in 2007 complained about the congestion of AAA titles released in the back half of the year, which resulted in cannibalization of sales of some of the year's best titles. The simExchange had predicted this tradeoff in sales between competing titles. This phenomenon likely affected industry decision makers as 2008 is looking to be a more spread out year for blockbuster titles.

Before the first half of 2008 ends, we can expect the release of AAA titles such as Super Smash Bros. Brawl (expected to achieve 13.95 million units of GLS), Wii Fit (expecting 8.7 million units of GLS), Grand Theft Auto IV (expecting 17 million units of GLS), and Metal Gear Solid 4 (expecting 4.7 million units of GLS).

Short-term economic factors can make any period of the year riskier for introducing new products, a phenomenon investors have experienced across the retail sector in Q4 2007. A broader release schedule could positively affect retailers such as GameStop and make them more attractive to the investment community as they will have more months of strong sales to hedge themselves against any negative short-term economic factors.

Price Points to Stay at a Premium

Since the inception of the next generation systems, it has been debated how long the new premium price points can hold. Given the expected 55% sales increase this holiday season and the slew of top rated titles in 2008, it is most probable that the current price points for premium games on their respected systems will remain unchanged. This will add another benefit to GameStop in 2008 as retail profits are not based on a fixed price, but instead a fixed margin percentage—around 20%. Additionally, as the current shift from the legacy systems to the current generation continues, there will be a higher ratio of games sold at the $59.99 premium price to legacy games sold in 2008. This will equate to a higher "average price per game" in 2008; in retail terms it is often called "average dollars per transaction".

"I think that the $60 price point not only will hold, but I think that publishers will continue to test higher price points during the year. In 2007, we saw Halo 3 collector's editions at $100 (or more), Guitar Hero at $100, Rock Band at $170. This year, we'll see the Grand Theft Auto bundle at $80 or $90, and will likely see a new offering from Guitar Hero with other instruments. I think you'll see a bunch of collector's edition games, and think that PS3 and 360 premium content will all debut at $60."

Michael Pachter – Wedbush Morgan

Publishers, Retailers, and Investors

Contact us below to find out how you can stay ahead of the competition by using some of our Industry Services.

Interview Requests

Both Jesse Divnich and Brian Shiau are available for interviews and direct comments from the media or the investment community. Please see this reports footnote for their contact information.

Media

This report and all forecasts on the simExchange Web site are available for your use. Please provide your readers context on the nature of these forecasts, for example: "The simExchange is an online virtual stock market in gamers, developers, and investors trade stock to predict how games will sell."

Jesse and Brian will offer quotes and/or analysis for your articles or any current event pertaining to the video game industry upon request. Any request should be made using the Contact Us form.

About The simExchange

The simExchange (www.thesimexchange.com) is the online prediction market for video games. Launched in November 2006, The simExchange allows thousands of gamers, developers, and industry watchers to forecast the video game industry. Participating in The simExchange is completely free and no real money is involved.

About Jesse Divnich

Jesse Divnich has been working in the video game industry for over 10 years. During that time he has assumed many professional roles including: beta tester, programmer, publisher analyst, and for the last 6 years, a private analyst and consultant for buy-side investment firms. Jesse Divnich has received many awards for his work in the private investment sector as an analyst covering publicly traded video game companies. Currently, Jesse Divnich has switched from the private sector to the public sector as an Analyst for The simExchange where he writes analytical articles on various industry topics.

Copyright and reprinting

The simExchange, LLC retains the right to the content of this article but permits the reprinting of this article with proper credit to The simExchange and Jesse Divnich.

The simExchange, LLC does not issue any investment ratings or investment recommendations for any publicly traded company. The accuracy of the opinions or data in this report is not a guarantee.

Permanent Link | Digg | del.icio.us | Facebook

About Us - The simExchange is the video game stock market and the source for video game sales forecasts.

November hardware sales

Console Prediction Today's Change Xbox 360 836K units 0.00% PS3 378K units 0.00% Wii 2.04M units 0.00% Nintendo DS 1.57M units 0.00% PSP 421K units 0.00% November software sales

Title Prediction Today's Change Call of Duty: World at War (Xbox 360) 1.41M copies 0.00% Call of Duty: World at War (PS3) 597K copies 0.00% Gears of War 2 (Xbox 360) 1.56M copies 0.00% Resistance: Fall of Man 2 (PS3) 385K copies 0.00% Total Software Sales () 1.45M copies 0.00% Wii Play (Wii) 796K copies 0.00% Subscribe research via email

Subscribers will receive reports before they are posted here.

Please use your company email address.

The Feed

Add the Research Feed

Add the Research Feed

-