December Preview Report

Jesse DivnichJanuary 14, 2008

Key Points

- Hardware sales

- Blu-Ray nearing victory, effect on PS3 sales

- Record software sales

- Top Selling SKU – Super Mario Galaxy, Call of Duty 4 or Halo 3?

- PS3 Half-Life 2 – PS3 Install Base Too Small

- Timeshift –A Trifecta of Bad Circumstances

This report is intended to aid industry professionals and the press in drawing insight and discovering trends occurring in the video game industry through the use of the simExchange video game prediction market (www.thesimexchange.com), a data aggregation system in which gamers, developers, and industry investors trade virtual video game stocks and futures to predict how video game products will sell and how they will be critically received.

The simExchange's Market Predictions

-

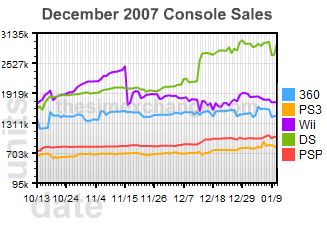

US Hardware in December 2007

Title Predicted unit sales Xbox 360 1,450,000 units PLAYSTATION 3 854,000 units Wii 1,730,000 units Nintendo DS 2,900,000 units PlayStation Portable 1,030,000 units

-

US Software in December 2007

Title Predicted unit sales Call of Duty 4: Modern Warfare (Xbox 360) 1,050,000 units Final Fantasy XII: Revenant Wings (DS) 109,000 units Half-Life 2: The Orange Box (PS3) 103,000 units Mario Party DS (DS) 353,000 units Mass Effect (Xbox 360) 505,000 units Nights: Journey of Dreams (Wii) 82,000 units Resident Evil: The Umbrella Chronicles (Wii) 126,000 units Super Mario Galaxy (Wii) 1,260,000 units TimeShift (PS3) 33,000 units Uncharted: Drake's Fortune (PS3) 142,000 units The prediction market is expecting the Wii to once again lead home console sales in December at 1.73 million units, a close second is the Xbox 360 at 1.45 million units, and last again is the PS3 at 854,000 units. On the portable side, it should be no surprise that the Nintendo DS will be the market leader at 2.90 million units and a distant second, the PSP at 1.03 million units. The prediction market's 2.9 million unit expectations would well ahead of the record for most units sold in one month, which is currently held by the PS2 in December 2002 at 2.68 million units.

The first notable observation of this month’s hardware expectations is the shrinking gap between the Wii and the Xbox 360, which was likely due to the Wii supply constraints in the American market. Because of this shortage, the industry should not consider the Wii results as a sign of slowing demand but rather the results of continued supply constraints.

Furthermore, the Xbox 360 only outsold the PS3 1.8 to 1 in November. For December, that gap is expected to shrink to 1.7 to 1, according to the prediction market. This may be a growing trend as the prediction market expects this gap closure to continue into January with a 1.5 to 1 ratio between Xbox 360s to PS3s sold. The closing gap in January can also be attributed to recent news that the Blu-Ray disc format will likely be the high definition disc media standard in the coming future. However, this growing standardization of Blu-Ray has not greatly affected short-term sales expectations as seen in the NPD Futures; therefore, future price cuts and better exclusive software will likely be the primary factor of closing the hardware sales gap until HD video content becomes a larger purchasing factor among consumers.

Blu-Ray nearing victory, effect on PS3 sales

It has become increasingly clear that Sony’s Blu-Ray disc will likely become the standard for high definition digital video discs, especially since Warner announced an exclusive deal with the BDA. This news had little effect on the prediction market’s global lifetime sales (GLS) expectations for the PS3, which currently stands at 55 million units, compared to the Xbox 360’s 58 million units. This indicates that the prediction market has priced in the likelihood of a Blu-Ray victory a long time ago, which shows how far in advance prediction markets can price in future events. Given that, any more incremental news of BDA’s triumph will likely not affect PS3 global lifetime sales. This recent news has also had no effect on the prediction market’s expectations for global lifetime sales of the Xbox 360.

The news has not substantially affected the short-term forecasts either, which is largely explained by the notion that the increasing standardization of Blu-Ray is not yet a motivating factor to purchase a PS3 over an Xbox 360.

This is a widget available for websites/bloggers to keep their viewers up to date on the console race. This is automatically updated daily. Code available here.

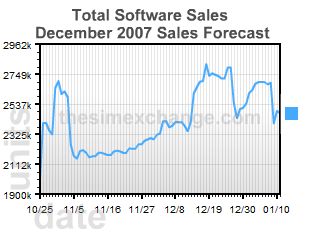

The prediction market expects December’s software sales to ring in at $2.48 billion, a 43% increase over sales last year. This would set a monthly industry software sales record, which was previously set in December 2006 at $1.72 billion. These sales were driven by the continued success of Guitar Hero 3, Halo 3, Zelda: Phantom Hourglass, Call of Duty 4, Mass Effect, and Super Mario Galaxy.

For most mass market retailers, December sales were dismal with most posting flat to near flat year-over-year retail sales. As stated in a previous report, the prediction market doesn’t expect this slowdown at retailers to affect video game sales to any significant degree, affecting mostly casual games and system, but only to a minor degree.

For January, the prediction market expects sales to be $586 million, a 7% increase year-over-year, but note that January 2006 was a five week month compared to this year’s four week month.

Top Selling SKU – Super Mario Galaxy, Call of Duty 4 or Halo 3?

Call of Duty 4 for the Xbox 360 has had astonishing success in November with over 1.57 million units sold. Continuing on that success, Xbox 360’s Call of Duty 4 is expected to ring in 1.05 million units for December for a combined total of 2.62 million units, making it the number one selling SKU this holiday season. A very close second is Super Mario Galaxy, which is expected to bring in 1.26 million units in December, which combined with November’s results (1.12 million units), would equate to 2.37 million units, just shy of Xbox 360’s Call of Duty 4.

On a side note, by retail standards, the holiday season runs from October to December, but if we include September into the equation, Halo 3 would emerge as the best selling SKU with over 4.1 million units sold going into December.

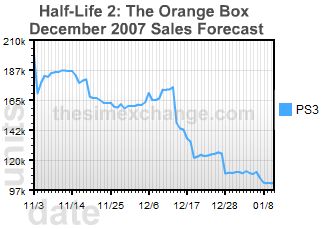

PS3 Half-Life 2 – PS3 Install Base Too Small

Back in October 2007, Half-Life 2: The Orange Box for the Xbox 360 sold 238,000 units. In December, we witnessed the release of its ported PS3 version. Typically, the consumer market dislikes staggered release dates as the last one to be released tend to post disappointing sales, likely due to less market buzz and media advertising. This theory holds true with the PS3 version of Half-Life 2: The Orange Box, which according to the prediction market is only expected to sell 103,000 units—an unsatisfactory figure. Also, a late release date was not the only factor as its first-person-shooter rival Call of Duty 4 likely cannibalized some of Half-Life 2: The Orange Box’s sales.

Arguments could be made that the Xbox 360 version of Half-Life 2: The Orange Box would sell better as it has a larger install base in the USA, but keep in mind that the Xbox 360 version was released in October, which only has 20% of the sales December will have.

For the holiday season, it appeared that the first person shooter market can only maintain two prosperous titles at any given time, for example on the Xbox 360, October was dominated by Half-Life 2: The Orange Box and Halo 3 while November/December were dominated by Call of Duty 4 and Halo 3. Unfortunately, the PS3 has such a small install base it is unable to successfully support two first-person-shooters in the same month. This theory will likely hold true for other great titles under the same genre with Uncharted: Drake’s Fortune and Ratchet & Clank Future: Tools of Destruction cannibalizing each other’s sales in December. This is evident in the prediction market’s expectations of Uncharted: Drake’s Fortune, which currently stands at only 142,000 units. Of course we do recognize that Uncharted and Ratchet & Clank are not technically in the same genre but given the PS3’s small install base, these two genres (action-combat and action-platform) tend to blend together in the eyes of consumers.

Long-term, we do not see this to be a major issue as most publishers/developers have learned their lesson and we will likely see more multi-platform simultaneous releases in the future. Also, with the growing PS3 install base, it will likely be able to support more than one successful title in the same genre by holiday 2008.

Timeshift –A Trifecta of Bad Circumstances

To extend further on the subject of staggered releases and cannibalization, Timeshift for the PS3 was released weeks after its PC and Xbox 360 counter-part. If a delayed release wasn’t bad enough, it was released in the same month of this year’s mega hit Call of Duty 4. What makes this a trifecta of bad circumstances was that the game was simply dreadful compared to the other first-person-shooters. This all equates to the lowest expectations for a title in December followed by the prediction market at only 33,000 units.

Publishers, Retailers, and Investors

Contact us below to find out how you can stay ahead of the competition by using some of our Industry Services.

Interview Requests

Both Jesse Divnich and Brian Shiau are available for interviews and direct comments from the media or the investment community. Please see this reports footnote for their contact information.

Media

This report and all forecasts on the simExchange Web site are available for your use. Please provide your readers context on the nature of these forecasts, for example: "The simExchange is an online virtual stock market in gamers, developers, and investors trade stock to predict how games will sell."

Jesse and Brian will offer quotes and/or analysis for your articles or any current event pertaining to the video game industry upon request. Any request should be made using the Contact Us form.

About The simExchange

The simExchange (www.thesimexchange.com) is the online prediction market for video games. Launched in November 2006, The simExchange allows thousands of gamers, developers, and industry watchers to forecast the video game industry. Participating in The simExchange is completely free and no real money is involved.

About Jesse Divnich

Jesse Divnich has been working in the video game industry for over 10 years. During that time he has assumed many professional roles including: beta tester, programmer, publisher analyst, and for the last 6 years, a private analyst and consultant for buy-side investment firms. Jesse Divnich has received many awards for his work in the private investment sector as an analyst covering publicly traded video game companies. Currently, Jesse Divnich has switched from the private sector to the public sector as an Analyst for The simExchange where he writes analytical articles on various industry topics.

Copyright and reprinting

The simExchange, LLC retains the right to the content of this article but permits the reprinting of this article with proper credit to The simExchange and Jesse Divnich.

The simExchange, LLC does not issue any investment ratings or investment recommendations for any publicly traded company. The accuracy of the opinions or data in this report is not a guarantee.

Permanent Link | Digg | del.icio.us | Facebook

About Us - The simExchange is the video game stock market and the source for video game sales forecasts.

November hardware sales

Console Prediction Today's Change Xbox 360 836K units 0.00% PS3 378K units 0.00% Wii 2.04M units 0.00% Nintendo DS 1.57M units 0.00% PSP 421K units 0.00% November software sales

Title Prediction Today's Change Call of Duty: World at War (Xbox 360) 1.41M copies 0.00% Call of Duty: World at War (PS3) 597K copies 0.00% Gears of War 2 (Xbox 360) 1.56M copies 0.00% Resistance: Fall of Man 2 (PS3) 385K copies 0.00% Total Software Sales () 1.45M copies 0.00% Wii Play (Wii) 796K copies 0.00% Subscribe research via email

Subscribers will receive reports before they are posted here.

Please use your company email address.

The Feed

Add the Research Feed

Add the Research Feed

-