December 2007 Review Report

Jesse DivnichJanuary 18, 2008

Key Points

- Software Sales in-line with Expectations

- Hardware Sales

- Activision Dominates the Holidays and the Year

- PS3 Install Base Too Small

- The PS2 Not Going Down without a Fight

Introduction

This report is intended to aid industry professionals and the press in drawing insight and discovering trends occurring in the video game industry through the use of the simExchange video game prediction market (www.thesimexchange.com), a data aggregation system in which gamers, developers, and industry investors trade virtual video game stocks and futures to predict how video game products will sell and how they will be critically received.

Software Sales in-line with Expectations

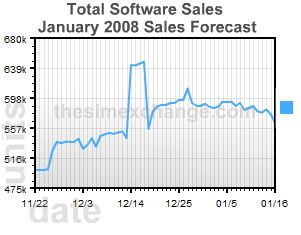

Software sales came in at $2.37 billion, a 36% increase year-over-year and in line with the prediction marketís expectation for $2.38 billion in December software sales, a mere -0.28% difference. Looking forward into January, the prediction market expects sales to ring in at $569 million, a 13.6% increase year-over-year, but as noted earlier, January 2008 only has four weeks of sales compared to January 2007ís five weeks. This increase will be driven once again by Call of Duty 4 on the Xbox 360 with 404,000 units, Super Mario Galaxy with 394,000 units, and newcomer Burnout Paradise for the PS3 with 120,000 units along with its Xbox 360 version. Looking into February, the prediction market expects overall software sales to be $536 million, an 18% year-over-year increase, which will be driven by strong titles like Devil May Cry 4, Turok, and Lost Odyssey.

The Nintendo Wii once again took the #1 spot for home consoles at 1.35 million units, and the Nintendo DS won once again on the portable side with 2.47 million units. Both these figures came in below market expectations, with the Nintendo DS coming up just shy of the record for most units sold in one month, held by the PS2 in December 2002 at 2.68 million units. We believe hardware shortages for both of the Wii and the DS played a significant role as to why both systems missed market expectations. As stated in our previous report, we expect the Wii to widen its gap from its closest competitor, the Xbox 360, as more hardware units become available.

Our NPD Preview report stated that the prediction market expected the Xbox 360 to outsell the PS3 1.7 to 1 in a closing gap; actual results were 1.58 to 1, a significant jump from November 2007ís 1.8 to 1 sales ratio. For January, the prediction market expects Xbox 360 sales to ring in at 358,000 units compared to PS3 salesís at 229,000 units, a 1.56 to 1 sales ratio. Even with Blu-Rayís recent victories over the HD-DVD media format, we do not expect this to have any significant impact on sales in the short-term until HD content becomes a larger purchasing factor among consumers. Exclusive video game software and future hardware price cuts will be the primary catalyst for closing the sales gap between itself and the Xbox 360.

-

US Hardware Expectations for January 2008

Title Expected units Nintendo Wii 535,000 units Nintendo DS 541,000 units Xbox 360 358,000 units PlayStation Portable 262,000 units PLAYSTATION 3 229,000 units Activision Dominates the Holidays and the Year

December proved to be yet again another successful month for Activision with Call of Duty 4 for the Xbox 360 taking the #1 spot for the second month in a row. It again surprised the market, which had only expected 929,900 units and rang in over 1.47 million units. Activisionís success did not stop there as the PS2 version of Guitar Hero III pulled in another 1.25 million units, a third place finish. If that wasnít enough, Activision also took the #9 spot with the Xbox 360 version of Guitar Hero III, which sold 624,000 units.

Reviewing sales for the entire year, Activision again takes 3 spots in the Top 10 with Call of Duty 4 (Xbox 360 ) at 3.04 million units, Guitar Hero III (PS2) at 2.72 million units, and Guitar Hero II (PS2) at 1.89 million units, placing #3, #4, and #8 respectively for overall unit sales in 2007.

To keep the momentum going, Xbox 360 Call of Duty 4 is expected to be the #1 selling title in January at 404,000 units, according to the prediction market.

PS3 Install Base Too Small

As previously stated in our preview report, the PS3 install base is currently too small to maintain prosperous sales on two or more titles in the same genre at the same time. As an example, we used the expected low sales of Half-Life 2: Orange Box and Timeshift in the overcrowded first person shooter genre. This was proven true as both posted even lower than expected sales with Half-Life 2: Orange Box only selling 56,600 units while Timeshift only selling 25,000 units. We do expect this to be a short-term phenomenon as the PS3ís install base continues to grow and becomes capable of supporting more than one title in the same genre in the future. The prediction market verifies this as a short-term phenomenon as Metal Gear Solid 4 and Grand Theft Auto IV (PS3), both considered action-adventure titles, are expected to have amazing sales at 4.85 million and 7.1 million units in global lifetime sales (GLS).

In our preview report we also stated that because of the Xbox 360ís larger install base, it can support at least 2 prosperous titles in a specific genre. This appeared to be accurate as December successfully supported Call of Duty 4 and Halo 3, while BioShock and Half-Life 2: Orange Box were nowhere to be seen in the top 10.

The PS2 Not Going Down without a Fight

Despite being a legacy system and often over-looked in the press, the PS2 still managed to give us two of the top ten software titles in December (Guitar Hero III and Madden 2008). Besides being for the PS2, both of the titles are also popular among casual gamers, a clear indication that there is still tremendous growth potential in the casual sector for the next-generation systems. This can also indicate that there are still many consumers who have still not made up their mind as to which next-generation system to purchase. It is difficult to indicate what is holding back these consumers from purchasing a next-generation system, but to win over this market, the console manufacturers must make 2008 one of their most aggressive years as 2008ís momentum will likely indicate the ďtrueĒ console war winner. This would mean that the Wii should continue to attempt to solve its hardware constrain issues. The Xbox 360 should continue to focus on its Xbox Live Market place, its software selection, and exclusives. The PS3ís best opportunity is to continue to cut hardware prices and advertise heavily on its software exclusives.

This is a widget available for websites/bloggers to keep their viewers up to date on the console race. This is automatically updated daily. Code available here.

-

US Hardware in December 2007

Title Actual units Expected units % From Expected Nintendo Wii 1,350,000 1,734,500 -22.17% Nintendo DS 2,470,000 2,854,000 -13.45% Xbox 360 1,260,000 1,461,000 -8.75% PlayStation Portable 1,060,000 1,054,600 +0.54% PLAYSTATION 3 797,600 874,100 -8.75% Total Hardware Units 6,937,600 7,978,200 -13.04%

-

US Software in December 2007

Rank Title Actual units Expected units % From Expected 1 Call of Duty 4 (Xbox 360) 1,470,000 929,900 +58.08% 2 Super Mario Galaxy (Wii) 1,400,000 1,275,200 +9.79% 3 Guitar Hero III: Legends of Rock (PS2) 1,250,000 -- -- 4 Wii Play (Wii) 1,080,000 -- -- 5 Assassin's Creed (Xbox 360) 893,700 -- -- 6 Halo 3 (Xbox 360) 742,700 -- -- 7 Brain Age 2 (DS) 659,500 -- -- 8 Madden NFL 08 (PS2) 655,200 -- -- 9 Guitar Hero III: Legends of Rock (Xbox 360) 624,600 -- -- 10 Mario & Sonic: Olympic Games (Wii) 613,000 -- -- NR Mass Effect (Xbox 360) 401,000 511,700 -21.63% NR Mario Party DS (DS) 385,700 365,000 +5.67% NR Uncharted: Drake's Fortune (PS3) 206,000 139,900 +47.25% NR Resident Evil: The Umbrella Chronicles (Wii) 147,600 134,400 +9.82% NR Final Fantasy XII: Revenant Wings (DS) 117,200 113,700 -3.08% NR Half-Life 2: The Orange Box (PS3) 56,500 106,900 -47.15% NR Nights: Journey of Dreams (Wii) 60,800 80,700 -24.66% NR TimeShift (PS3) 25,000 32,000 -21.88% Total Tracked Software Units 4,269,800 3,688,500 +15.73% Total Software Sales $2.37 billion $2.38 billion -0.28% *(Exclusive NPD Data provided to The simExchange in Blue)

Results based on NPD data have consistently shown that The simExchange prediction market can predict results not only more accurately than traditional models and surveys, but also more quickly adjust forecasts based on industry and product news.

Publishers, Retailers, and Investors

Contact us below to find out how you can stay ahead of the competition by using some of our Industry Services.

Interview Requests

Both Jesse Divnich and Brian Shiau are available for interviews and direct comments from the media or the investment community. Please see this reports footnote for their contact information.

Media

This report and all forecasts on the simExchange Web site are available for your use. Please provide your readers context on the nature of these forecasts, for example: "The simExchange is an online virtual stock market in gamers, developers, and investors trade stock to predict how games will sell."

Jesse and Brian will offer quotes and/or analysis for your articles or any current event pertaining to the video game industry upon request. Any request should be made using the Contact Us form.

About The simExchange

The simExchange (www.thesimexchange.com) is the online prediction market for video games. Launched in November 2006, The simExchange allows thousands of gamers, developers, and industry watchers to forecast the video game industry. Participating in The simExchange is completely free and no real money is involved.

About Jesse Divnich

Jesse Divnich has been working in the video game industry for over 10 years. During that time he has assumed many professional roles including: beta tester, programmer, publisher analyst, and for the last 6 years, a private analyst and consultant for buy-side investment firms. Jesse Divnich has received many awards for his work in the private investment sector as an analyst covering publicly traded video game companies. Currently, Jesse Divnich has switched from the private sector to the public sector as an Analyst for The simExchange where he writes analytical articles on various industry topics.

Copyright and reprinting

The simExchange, LLC retains the right to the content of this article but permits the reprinting of this article with proper credit to The simExchange and Jesse Divnich.

The simExchange, LLC does not issue any investment ratings or investment recommendations for any publicly traded company. The accuracy of the opinions or data in this report is not a guarantee.

Permanent Link | Digg | del.icio.us | Facebook

About Us - The simExchange is the video game stock market and the source for video game sales forecasts.

November hardware sales

Console Prediction Today's Change Xbox 360 836K units 0.00% PS3 378K units 0.00% Wii 2.04M units 0.00% Nintendo DS 1.57M units 0.00% PSP 421K units 0.00% November software sales

Title Prediction Today's Change Call of Duty: World at War (Xbox 360) 1.41M copies 0.00% Call of Duty: World at War (PS3) 597K copies 0.00% Gears of War 2 (Xbox 360) 1.56M copies 0.00% Resistance: Fall of Man 2 (PS3) 385K copies 0.00% Total Software Sales () 1.45M copies 0.00% Wii Play (Wii) 796K copies 0.00% Subscribe research via email

Subscribers will receive reports before they are posted here.

Please use your company email address.

The Feed

Add the Research Feed

Add the Research Feed

-

-