January 2008 Review Report

Jesse DivnichFebruary 15, 2008

Key Points

- Hardware Results-PS3 Triumphs and The Wii Falls Short

- Call of Duty 4 Claims its Third Victory

- Burnout Paradise on Top for New Releases

- Super Mario Galaxy Underperforms

- Rocking It Out

Introduction

This report is intended to aid industry professionals and the press in drawing insight and discovering trends occurring in the video game industry through the use of the simExchange video game prediction market (www.thesimexchange.com), a data aggregation system in which gamers, developers, and industry investors trade virtual video game stocks and futures to predict how video game products will sell and how they will be critically received.

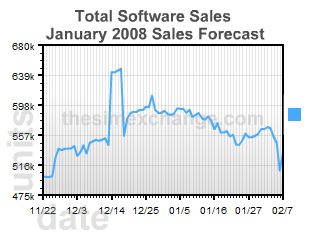

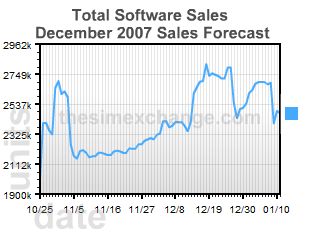

Total Software Sales

Total software sales came in at $610 million, an 11% increase over January 2007, even considering that January 2008 included one less week in retail accounting. These strong sales were driven by premium titles such as Call of Duty 4, Guitar Hero III, Rock Band, and newcomer Burnout Paradise.

The prediction market quickly priced in this news as February’s overall software sales expectations rose to $586 million, a 32% increase over last year’s $441 million.

Hardware Results-PS3 Triumphs and the Wii Falls Short

The biggest upset of the month is the PS3 triumphant victory over the Xbox 360, marking the first time the system has outsold its chief rival in the US since launch. Although, we do not know to what extent a hardware shortage played on Xbox 360 sales, it is likely the PS3 is beginning to change the tides on its rival. This assumption is implied by the prediction market’s February expectations, which forecasts the PS3 to outsell the Xbox 360, 289,000 units to 275,000 units, respectively. The most interesting aspect of this shift is that neither side had any exclusive titles nor hardware price drops in January. Possible factors amounting to this shift include Sony’s Blu-Ray gaining traction as the HD format of choice and Sony PS2 loyalists finally making the next-generation jump.

The Nintendo Wii posted dismal results in January, which at first glance may indicate a performance issue with its consumer demand that dominated 2007. Examing the forward looking data can explain the story. February’s expectations have decreased by 15%, down to 407,000 units since NPD released its data while March’s expectations have increased by 3% to 463,000 units. The prediction market is predicting decreased sales to persist through February but to return to normal in March. The market may believe that Nintendo will ensure sufficient supply to support its March North American release of Super Smash Bros. Brawl (Wii), currently forecast to sell 2 million copies in March. This implies a possible explanation for decreased Wii sales in January and February as being Wii hardware was diverted from the United States to support the Japanese release of Smash Bros Brawl.

Call of Duty 4 Claims its Third Victory

Already holding the crown for November and December 2007, Call of Duty 4 added another notch to its belt by claiming a victory in January with the Xbox 360 SKU taking the top spot. A repeat in February is unlikely as the prediction market is expecting Devil May Cry 4 for the Xbox 360 to sell 393,000 units and an increase in month-over-month sales for Call of Duty 4 is highly unlikely.

Burnout Paradise on Top for New Releases

Burnout Paradise led sales among new releases in January with the Xbox 360 version selling 144,000 units. This was inline with our estimate of 151,000 units, which was generated without the listing of an NPD Future for this title. This indicates that extrapolation of sales ratios between the GLS Stocks for different platform versions can be useful in predicting the monthly sales of platform versions that are not listed on the exchange.

This technique can also be applied to this month’s Call of Duty SKUs, which we only had a Xbox 360 version listed. Per our GLS stock of both SKUs, the Xbox 360 version is expected to outsell the PS3 version by a 2.72 to 1 ratio. Applying this to the 359,700 units forecasted by the Xbox 360 January 2008 NPD Future, we can predict the PS3 version sold 132,242 units, which is quite close to the actual 140,100 units. This new technique only adds to the many tools The simExchange can provide the industry for forecasting sales.

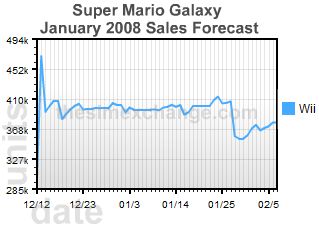

Super Mario Galaxy Underperforms

Super Mario Galaxy sold 172,000 units, well below market expectations. Given that Super Mario Galaxy makes a great tie in purchase for any new Wii owner, the dismal Wii hardware sales for January likely hindered sales of Super Mario Galaxy.

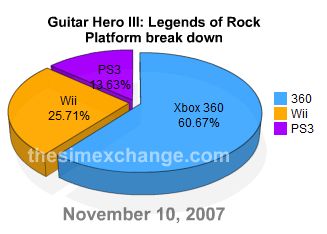

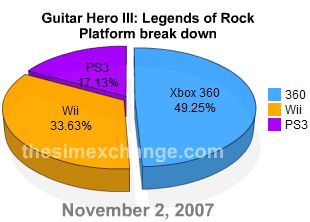

Guitar Hero III for the Wii led the month among all the Guitar Hero III and Rock Band SKUs with 239,600 units sold, 36% above market expectations. On the Xbox 360 side, Rock Band inched out Guitar Hero III, 183,800 to 182,700 units, respectively. These strong sales of both Rock Band and Guitar Hero III continue to support the theory that social gaming is emerging as one of the most prosperous genres for publishers in the industry.

-

US Hardware in January 2008

Title Actual units Expected units % From Expected Nintendo Wii 274,000 396,900 -30.96% Nintendo DS 251,000 483,700 -48.11% Xbox 360 230,000 288,600 -20.30% PlayStation Portable 230,000 233,000 -1.29% PLAYSTATION 3 269,000 209,300 +28.52% Total Hardware Units 1,227,000 1,611,500 -23.86%

-

US Software in January 2008

Rank Title Actual units Expected units % From Expected 1 Call of Duty 4: Modern Warfare (Xbox 360) 330,900 359,700 -8.01% 2 Wii Play (Wii) 298,100 -- -- 3 Guitar Hero III: Legends of Rock (Wii) 239,600 175,900 +36.21% 4 Rock Band (Xbox 360) 183,800 197,300 -6.84% 5 Guitar Hero III: Legends of Rock (Xbox 360) 182,700 -- -- 6 Super Mario Galaxy (Wii) 172,000 391,800 -56.1% 7 Burnout Paradise (Xbox 360) 144,100 -- -- 8 Call of Duty 4: Modern Warfare (PS3) 140,000 -- -- 9 Mario Party DS (DS) 138,500 -- -- 10 Mario & Sonic at the Olympic Games (DS) 133,000 154,400 -13.86% NR Burnout Paradise (PS3) 83,000 110,900 -25.16% NR Advance Wars: Days of Ruin (DS) 81,000 102,400 -20.9% NR Kingdom Under Fire: Circle of Doom (Xbox 360) 52,000 80,300 -35.24% NR Sonic Riders: Zero Gravity (Wii) 39,000 97,500 -60.00% Total Tracked Software Units 1,314,300 1,670,200 -21.31% Total Software Sales $610.6 million $523.1 million +16.73% *(Exclusive NPD Data provided to The simExchange in Blue)

Results based on NPD data have consistently shown that The simExchange prediction market can predict results not only more accurately than traditional models and surveys, but also more quickly adjust forecasts based on industry and product news.

Publishers, Retailers, and Investors

Contact us below to find out how you can stay ahead of the competition by using some of our Industry Services.

Interview Requests

Both Jesse Divnich and Brian Shiau are available for interviews and direct comments from the media or the investment community. Please see this reports footnote for their contact information.

Media

This report and all forecasts on the simExchange Web site are available for your use. Please provide your readers context on the nature of these forecasts, for example: "The simExchange is an online virtual stock market in gamers, developers, and investors trade stock to predict how games will sell."

Jesse and Brian will offer quotes and/or analysis for your articles or any current event pertaining to the video game industry upon request. Any request should be made using the Contact Us form.

About The simExchange

The simExchange (www.thesimexchange.com) is the online prediction market for video games. Launched in November 2006, The simExchange allows thousands of gamers, developers, and industry watchers to forecast the video game industry. Participating in The simExchange is completely free and no real money is involved.

About Jesse Divnich

Jesse Divnich has been working in the video game industry for over 10 years. During that time he has assumed many professional roles including: beta tester, programmer, publisher analyst, and for the last 6 years, a private analyst and consultant for buy-side investment firms. Jesse Divnich has received many awards for his work in the private investment sector as an analyst covering publicly traded video game companies. Currently, Jesse Divnich has switched from the private sector to the public sector as an Analyst for The simExchange where he writes analytical articles on various industry topics.

Copyright and reprinting

The simExchange, LLC retains the right to the content of this article but permits the reprinting of this article with proper credit to The simExchange and Jesse Divnich.

The simExchange, LLC does not issue any investment ratings or investment recommendations for any publicly traded company. The accuracy of the opinions or data in this report is not a guarantee.

Permanent Link | Digg | del.icio.us | FacebookJanuary 2008 Preview Report

Jesse Divnich

February 11, 2008

Key Points

- Total Software Sales

- Hardware sales

- Mario marches past Call of Duty 4

- Burnout Paradise Finishes Strong

- A Few Heroes

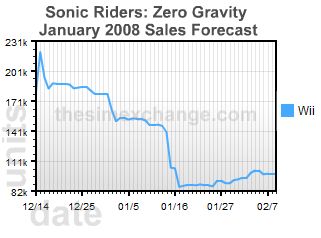

- Sonic Flops without Mario

This report is intended to aid industry professionals and the press in drawing insight and discovering trends occurring in the video game industry through the use of the simExchange video game prediction market (www.thesimexchange.com), a data aggregation system in which gamers, developers, and industry investors trade virtual video game stocks and futures to predict how video game products will sell and how they will be critically received.

The simExchange's Market Predictions

-

US Hardware in January 2008

Title Predicted unit sales Xbox 360 289,000 units PLAYSTATION 3 200,000 units Wii 403,000 units Nintendo DS 460,000 units PlayStation Portable 250,000 units

-

US Software in January 2008

Title Predicted unit sales Advance Wars: Days of Ruin (DS) 101,000 units Burnout Paradise (PS3) 107,000 units Call of Duty 4: Modern Warfare (Xbox 360) 336,000 units Guitar Hero III: Legends of Rock (Wii) 180,000 units Kingdom Under Fire: Circle of Doom (Xbox 360) 84,000 units Mario & Sonic at the Olympic Games (DS) 149,000 units Rock Band (Xbox 360) 196,000 units Sonic Riders: Zero Gravity (Wii) 99,000 units Super Mario Galaxy (Wii) 378,000 units

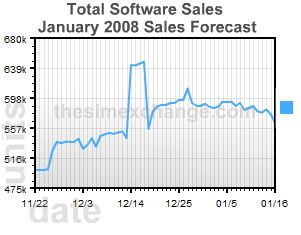

Total software sales are expected to ring in at $519 million, a -5.46% change compared to last year. It should be noted that January 2007 consisted of 5 weeks compared to January 2008, which only consisted of 4 weeks of retail sales. Adding in a 5th week to January 2008 would have likely resulted in retail sales of $648 million, an 18% increase over last year.

January 2008 sales were driven strongly by the continued success of Super Mario Galaxy, Wii Play, Guitar Hero, Call of Duty 4, and Rock Band. January’s new releases also played a significant role in driving sales, specifically Electronic Art's Burnout Paradise, Nintendo’s Advanced Wars: Days of Ruin, and Sega’s Mario & Sonic at the Olympic Games (DS).

For January, the prediction market expects Nintendo to conquer again in terms of hardware sales with the Wii and the DS taking the top spot in both the home and portable categories at 403,000 units and 460,000 units, respectively. Furthermore on the home console side, the Xbox 360 is expected to take the runner-up spot at 289,000 units and the PS3 to place third again at 200,000 units.

Although there were no momentous changes in hardware trends, it should be noted that the Xbox 360 is expected to outsell the PS3 by 1.44 to 1, a decrease from November’s 1.65 to 1 and December’s 1.58 to 1. We consider this noteworthy as neither system had any superior exclusive releases or price drops in January and could be an early sign of the PS3 gathering momentum on the Xbox 360.

Mario marches past Call of Duty 4

According to the prediction market, January’s top selling SKU will be Super Mario Galaxy for the Nintendo Wii at 378,000 units. This would dethrone Call of Duty 4 for the Xbox 360, which led the November and December charts as the top selling SKU.

Long-term, the prediction market expects Super Mario Galaxy to outsell the Xbox 360 version of Call of Duty 4 in Global Lifetime Sales (GLS): 13.46 million to 7.66 million units. However, these figures may be miss-leading in implying the greater success of Super Mario Galaxy as the prediction market expects a 12% market penetration for Call of Duty 4 (Xbox 360) compared to Super Mario Galaxy (Wii)’s 11% market penetration. For reference, the prediction market expects 60 million units in GLS for the Xbox 360 and 122 million units in GLS for the Wii.

Burnout Paradise Finishes Strong

Electronic Arts had a rough 2007 holiday season with the majority of its yearly titles performing below market expectations; however, Burnout Paradise has started a new year to positive reception. For January, the prediction market expects over 107,000 units sold for the PS3 version.

Although the simExchange did not list an NPD Future for the Xbox 360 version, we can estimate its sales by applying the ratio between the GLS stocks of both versions, which compares 1.92 million to 1.36 million (1.41 to 1) for the Xbox 360 and the PS3, respectively. This would project that the Xbox 360 version likely sold 151,000 units in January, for a monthly total of 258,000 units for both SKUs. These expectations will likely make Burnout Paradise the number one selling new release in January.

The simExchange did not list Ubisoft’s No More Heroes as a January NPD Future; however, the game is tracked for its second month of sales in February. The simExchange also lists a GLS stock, which is forecasting an underwhelming 712,000 units for GLS. This comes as a disappointment as it has long been assumed that the Nintendo Wii’s low software tie in ratio was due to lackluster third-party releases. Currently, No More Heroes holds the 4th highest Wii Metacritic score at 83 and despite its superior gameplay, it is clear that there still remain hurdles on the Wii for not only third-party publishers, but for titles that attempt to target the core gaming audience.

"No More Heroes (NMH) is a step in the right direction for the Wii platform. Even though sales may not be stellar compared to what the game probably could have garnered on a different console it is important for game developers to begin to create games for the Wii that are more immersive. For the Wii to continue to have strong sales and not get cornered into a party game system it must prove it can sustain titles that appeal to a more hard core audience. NMH is an important attempt at helping the Wii reaches its full potential."

Ben Bajarin – Creative Strategies

Sega and the Sonic franchise achieved great success in December 2007 by teaming up with the Mario brand for "Mario & Sonic at the Olympics" for the Wii, which ranked #10 in overall unit sales in December at 613,000 units.

Hoping to continue the momentum, Sega released a follow-up Sonic game on the Wii titled Sonic Riders: Zero Gravity. Despite strong momentum in December, the prediction market began downgrading the title as review scores came in under expectations. Currently, the prediction market expects 99,000 units in January and Metacritic ranks Sonic Riders: Zero Gravity with an aggregated review score of 58 out of 100—definitely underwhelming.

Publishers, Retailers, and Investors

Contact us below to find out how you can stay ahead of the competition by using some of our Industry Services.

Interview Requests

Both Jesse Divnich and Brian Shiau are available for interviews and direct comments from the media or the investment community. Please see this reports footnote for their contact information.

Media

This report and all forecasts on the simExchange Web site are available for your use. Please provide your readers context on the nature of these forecasts, for example: "The simExchange is an online virtual stock market in gamers, developers, and investors trade stock to predict how games will sell."

Jesse and Brian will offer quotes and/or analysis for your articles or any current event pertaining to the video game industry upon request. Any request should be made using the Contact Us form.

About The simExchange

The simExchange (www.thesimexchange.com) is the online prediction market for video games. Launched in November 2006, The simExchange allows thousands of gamers, developers, and industry watchers to forecast the video game industry. Participating in The simExchange is completely free and no real money is involved.

About Jesse Divnich

Jesse Divnich has been working in the video game industry for over 10 years. During that time he has assumed many professional roles including: beta tester, programmer, publisher analyst, and for the last 6 years, a private analyst and consultant for buy-side investment firms. Jesse Divnich has received many awards for his work in the private investment sector as an analyst covering publicly traded video game companies. Currently, Jesse Divnich has switched from the private sector to the public sector as an Analyst for The simExchange where he writes analytical articles on various industry topics.

Copyright and reprinting

The simExchange, LLC retains the right to the content of this article but permits the reprinting of this article with proper credit to The simExchange and Jesse Divnich.

The simExchange, LLC does not issue any investment ratings or investment recommendations for any publicly traded company. The accuracy of the opinions or data in this report is not a guarantee.

Permanent Link | Digg | del.icio.us | FacebookDecember 2007 Review Report

Jesse Divnich

January 18, 2008

Key Points

- Software Sales in-line with Expectations

- Hardware Sales

- Activision Dominates the Holidays and the Year

- PS3 Install Base Too Small

- The PS2 Not Going Down without a Fight

Introduction

This report is intended to aid industry professionals and the press in drawing insight and discovering trends occurring in the video game industry through the use of the simExchange video game prediction market (www.thesimexchange.com), a data aggregation system in which gamers, developers, and industry investors trade virtual video game stocks and futures to predict how video game products will sell and how they will be critically received.

Software Sales in-line with Expectations

Software sales came in at $2.37 billion, a 36% increase year-over-year and in line with the prediction market’s expectation for $2.38 billion in December software sales, a mere -0.28% difference. Looking forward into January, the prediction market expects sales to ring in at $569 million, a 13.6% increase year-over-year, but as noted earlier, January 2008 only has four weeks of sales compared to January 2007’s five weeks. This increase will be driven once again by Call of Duty 4 on the Xbox 360 with 404,000 units, Super Mario Galaxy with 394,000 units, and newcomer Burnout Paradise for the PS3 with 120,000 units along with its Xbox 360 version. Looking into February, the prediction market expects overall software sales to be $536 million, an 18% year-over-year increase, which will be driven by strong titles like Devil May Cry 4, Turok, and Lost Odyssey.

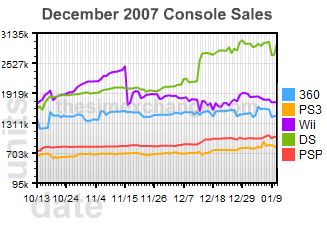

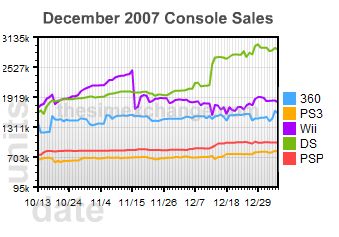

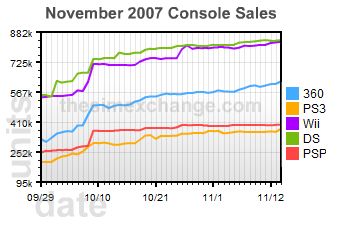

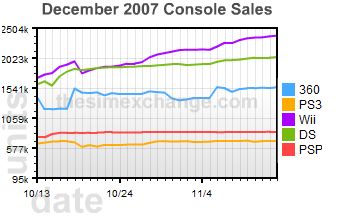

The Nintendo Wii once again took the #1 spot for home consoles at 1.35 million units, and the Nintendo DS won once again on the portable side with 2.47 million units. Both these figures came in below market expectations, with the Nintendo DS coming up just shy of the record for most units sold in one month, held by the PS2 in December 2002 at 2.68 million units. We believe hardware shortages for both of the Wii and the DS played a significant role as to why both systems missed market expectations. As stated in our previous report, we expect the Wii to widen its gap from its closest competitor, the Xbox 360, as more hardware units become available.

Our NPD Preview report stated that the prediction market expected the Xbox 360 to outsell the PS3 1.7 to 1 in a closing gap; actual results were 1.58 to 1, a significant jump from November 2007’s 1.8 to 1 sales ratio. For January, the prediction market expects Xbox 360 sales to ring in at 358,000 units compared to PS3 sales’s at 229,000 units, a 1.56 to 1 sales ratio. Even with Blu-Ray’s recent victories over the HD-DVD media format, we do not expect this to have any significant impact on sales in the short-term until HD content becomes a larger purchasing factor among consumers. Exclusive video game software and future hardware price cuts will be the primary catalyst for closing the sales gap between itself and the Xbox 360.

-

US Hardware Expectations for January 2008

Title Expected units Nintendo Wii 535,000 units Nintendo DS 541,000 units Xbox 360 358,000 units PlayStation Portable 262,000 units PLAYSTATION 3 229,000 units Activision Dominates the Holidays and the Year

December proved to be yet again another successful month for Activision with Call of Duty 4 for the Xbox 360 taking the #1 spot for the second month in a row. It again surprised the market, which had only expected 929,900 units and rang in over 1.47 million units. Activision’s success did not stop there as the PS2 version of Guitar Hero III pulled in another 1.25 million units, a third place finish. If that wasn’t enough, Activision also took the #9 spot with the Xbox 360 version of Guitar Hero III, which sold 624,000 units.

Reviewing sales for the entire year, Activision again takes 3 spots in the Top 10 with Call of Duty 4 (Xbox 360 ) at 3.04 million units, Guitar Hero III (PS2) at 2.72 million units, and Guitar Hero II (PS2) at 1.89 million units, placing #3, #4, and #8 respectively for overall unit sales in 2007.

To keep the momentum going, Xbox 360 Call of Duty 4 is expected to be the #1 selling title in January at 404,000 units, according to the prediction market.

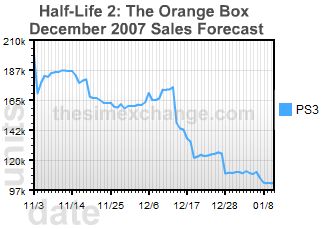

PS3 Install Base Too Small

As previously stated in our preview report, the PS3 install base is currently too small to maintain prosperous sales on two or more titles in the same genre at the same time. As an example, we used the expected low sales of Half-Life 2: Orange Box and Timeshift in the overcrowded first person shooter genre. This was proven true as both posted even lower than expected sales with Half-Life 2: Orange Box only selling 56,600 units while Timeshift only selling 25,000 units. We do expect this to be a short-term phenomenon as the PS3’s install base continues to grow and becomes capable of supporting more than one title in the same genre in the future. The prediction market verifies this as a short-term phenomenon as Metal Gear Solid 4 and Grand Theft Auto IV (PS3), both considered action-adventure titles, are expected to have amazing sales at 4.85 million and 7.1 million units in global lifetime sales (GLS).

In our preview report we also stated that because of the Xbox 360’s larger install base, it can support at least 2 prosperous titles in a specific genre. This appeared to be accurate as December successfully supported Call of Duty 4 and Halo 3, while BioShock and Half-Life 2: Orange Box were nowhere to be seen in the top 10.

The PS2 Not Going Down without a Fight

Despite being a legacy system and often over-looked in the press, the PS2 still managed to give us two of the top ten software titles in December (Guitar Hero III and Madden 2008). Besides being for the PS2, both of the titles are also popular among casual gamers, a clear indication that there is still tremendous growth potential in the casual sector for the next-generation systems. This can also indicate that there are still many consumers who have still not made up their mind as to which next-generation system to purchase. It is difficult to indicate what is holding back these consumers from purchasing a next-generation system, but to win over this market, the console manufacturers must make 2008 one of their most aggressive years as 2008’s momentum will likely indicate the “true” console war winner. This would mean that the Wii should continue to attempt to solve its hardware constrain issues. The Xbox 360 should continue to focus on its Xbox Live Market place, its software selection, and exclusives. The PS3’s best opportunity is to continue to cut hardware prices and advertise heavily on its software exclusives.

This is a widget available for websites/bloggers to keep their viewers up to date on the console race. This is automatically updated daily. Code available here.

-

US Hardware in December 2007

Title Actual units Expected units % From Expected Nintendo Wii 1,350,000 1,734,500 -22.17% Nintendo DS 2,470,000 2,854,000 -13.45% Xbox 360 1,260,000 1,461,000 -8.75% PlayStation Portable 1,060,000 1,054,600 +0.54% PLAYSTATION 3 797,600 874,100 -8.75% Total Hardware Units 6,937,600 7,978,200 -13.04%

-

US Software in December 2007

Rank Title Actual units Expected units % From Expected 1 Call of Duty 4 (Xbox 360) 1,470,000 929,900 +58.08% 2 Super Mario Galaxy (Wii) 1,400,000 1,275,200 +9.79% 3 Guitar Hero III: Legends of Rock (PS2) 1,250,000 -- -- 4 Wii Play (Wii) 1,080,000 -- -- 5 Assassin's Creed (Xbox 360) 893,700 -- -- 6 Halo 3 (Xbox 360) 742,700 -- -- 7 Brain Age 2 (DS) 659,500 -- -- 8 Madden NFL 08 (PS2) 655,200 -- -- 9 Guitar Hero III: Legends of Rock (Xbox 360) 624,600 -- -- 10 Mario & Sonic: Olympic Games (Wii) 613,000 -- -- NR Mass Effect (Xbox 360) 401,000 511,700 -21.63% NR Mario Party DS (DS) 385,700 365,000 +5.67% NR Uncharted: Drake's Fortune (PS3) 206,000 139,900 +47.25% NR Resident Evil: The Umbrella Chronicles (Wii) 147,600 134,400 +9.82% NR Final Fantasy XII: Revenant Wings (DS) 117,200 113,700 -3.08% NR Half-Life 2: The Orange Box (PS3) 56,500 106,900 -47.15% NR Nights: Journey of Dreams (Wii) 60,800 80,700 -24.66% NR TimeShift (PS3) 25,000 32,000 -21.88% Total Tracked Software Units 4,269,800 3,688,500 +15.73% Total Software Sales $2.37 billion $2.38 billion -0.28% *(Exclusive NPD Data provided to The simExchange in Blue)

Results based on NPD data have consistently shown that The simExchange prediction market can predict results not only more accurately than traditional models and surveys, but also more quickly adjust forecasts based on industry and product news.

Publishers, Retailers, and Investors

Contact us below to find out how you can stay ahead of the competition by using some of our Industry Services.

Interview Requests

Both Jesse Divnich and Brian Shiau are available for interviews and direct comments from the media or the investment community. Please see this reports footnote for their contact information.

Media

This report and all forecasts on the simExchange Web site are available for your use. Please provide your readers context on the nature of these forecasts, for example: "The simExchange is an online virtual stock market in gamers, developers, and investors trade stock to predict how games will sell."

Jesse and Brian will offer quotes and/or analysis for your articles or any current event pertaining to the video game industry upon request. Any request should be made using the Contact Us form.

About The simExchange

The simExchange (www.thesimexchange.com) is the online prediction market for video games. Launched in November 2006, The simExchange allows thousands of gamers, developers, and industry watchers to forecast the video game industry. Participating in The simExchange is completely free and no real money is involved.

About Jesse Divnich

Jesse Divnich has been working in the video game industry for over 10 years. During that time he has assumed many professional roles including: beta tester, programmer, publisher analyst, and for the last 6 years, a private analyst and consultant for buy-side investment firms. Jesse Divnich has received many awards for his work in the private investment sector as an analyst covering publicly traded video game companies. Currently, Jesse Divnich has switched from the private sector to the public sector as an Analyst for The simExchange where he writes analytical articles on various industry topics.

Copyright and reprinting

The simExchange, LLC retains the right to the content of this article but permits the reprinting of this article with proper credit to The simExchange and Jesse Divnich.

The simExchange, LLC does not issue any investment ratings or investment recommendations for any publicly traded company. The accuracy of the opinions or data in this report is not a guarantee.

Permanent Link | Digg | del.icio.us | FacebookDecember Preview Report

Jesse Divnich

January 14, 2008

Key Points

- Hardware sales

- Blu-Ray nearing victory, effect on PS3 sales

- Record software sales

- Top Selling SKU – Super Mario Galaxy, Call of Duty 4 or Halo 3?

- PS3 Half-Life 2 – PS3 Install Base Too Small

- Timeshift –A Trifecta of Bad Circumstances

This report is intended to aid industry professionals and the press in drawing insight and discovering trends occurring in the video game industry through the use of the simExchange video game prediction market (www.thesimexchange.com), a data aggregation system in which gamers, developers, and industry investors trade virtual video game stocks and futures to predict how video game products will sell and how they will be critically received.

The simExchange's Market Predictions

-

US Hardware in December 2007

Title Predicted unit sales Xbox 360 1,450,000 units PLAYSTATION 3 854,000 units Wii 1,730,000 units Nintendo DS 2,900,000 units PlayStation Portable 1,030,000 units

-

US Software in December 2007

Title Predicted unit sales Call of Duty 4: Modern Warfare (Xbox 360) 1,050,000 units Final Fantasy XII: Revenant Wings (DS) 109,000 units Half-Life 2: The Orange Box (PS3) 103,000 units Mario Party DS (DS) 353,000 units Mass Effect (Xbox 360) 505,000 units Nights: Journey of Dreams (Wii) 82,000 units Resident Evil: The Umbrella Chronicles (Wii) 126,000 units Super Mario Galaxy (Wii) 1,260,000 units TimeShift (PS3) 33,000 units Uncharted: Drake's Fortune (PS3) 142,000 units The prediction market is expecting the Wii to once again lead home console sales in December at 1.73 million units, a close second is the Xbox 360 at 1.45 million units, and last again is the PS3 at 854,000 units. On the portable side, it should be no surprise that the Nintendo DS will be the market leader at 2.90 million units and a distant second, the PSP at 1.03 million units. The prediction market's 2.9 million unit expectations would well ahead of the record for most units sold in one month, which is currently held by the PS2 in December 2002 at 2.68 million units.

The first notable observation of this month’s hardware expectations is the shrinking gap between the Wii and the Xbox 360, which was likely due to the Wii supply constraints in the American market. Because of this shortage, the industry should not consider the Wii results as a sign of slowing demand but rather the results of continued supply constraints.

Furthermore, the Xbox 360 only outsold the PS3 1.8 to 1 in November. For December, that gap is expected to shrink to 1.7 to 1, according to the prediction market. This may be a growing trend as the prediction market expects this gap closure to continue into January with a 1.5 to 1 ratio between Xbox 360s to PS3s sold. The closing gap in January can also be attributed to recent news that the Blu-Ray disc format will likely be the high definition disc media standard in the coming future. However, this growing standardization of Blu-Ray has not greatly affected short-term sales expectations as seen in the NPD Futures; therefore, future price cuts and better exclusive software will likely be the primary factor of closing the hardware sales gap until HD video content becomes a larger purchasing factor among consumers.

Blu-Ray nearing victory, effect on PS3 sales

It has become increasingly clear that Sony’s Blu-Ray disc will likely become the standard for high definition digital video discs, especially since Warner announced an exclusive deal with the BDA. This news had little effect on the prediction market’s global lifetime sales (GLS) expectations for the PS3, which currently stands at 55 million units, compared to the Xbox 360’s 58 million units. This indicates that the prediction market has priced in the likelihood of a Blu-Ray victory a long time ago, which shows how far in advance prediction markets can price in future events. Given that, any more incremental news of BDA’s triumph will likely not affect PS3 global lifetime sales. This recent news has also had no effect on the prediction market’s expectations for global lifetime sales of the Xbox 360.

The news has not substantially affected the short-term forecasts either, which is largely explained by the notion that the increasing standardization of Blu-Ray is not yet a motivating factor to purchase a PS3 over an Xbox 360.

This is a widget available for websites/bloggers to keep their viewers up to date on the console race. This is automatically updated daily. Code available here.

The prediction market expects December’s software sales to ring in at $2.48 billion, a 43% increase over sales last year. This would set a monthly industry software sales record, which was previously set in December 2006 at $1.72 billion. These sales were driven by the continued success of Guitar Hero 3, Halo 3, Zelda: Phantom Hourglass, Call of Duty 4, Mass Effect, and Super Mario Galaxy.

For most mass market retailers, December sales were dismal with most posting flat to near flat year-over-year retail sales. As stated in a previous report, the prediction market doesn’t expect this slowdown at retailers to affect video game sales to any significant degree, affecting mostly casual games and system, but only to a minor degree.

For January, the prediction market expects sales to be $586 million, a 7% increase year-over-year, but note that January 2006 was a five week month compared to this year’s four week month.

Top Selling SKU – Super Mario Galaxy, Call of Duty 4 or Halo 3?

Call of Duty 4 for the Xbox 360 has had astonishing success in November with over 1.57 million units sold. Continuing on that success, Xbox 360’s Call of Duty 4 is expected to ring in 1.05 million units for December for a combined total of 2.62 million units, making it the number one selling SKU this holiday season. A very close second is Super Mario Galaxy, which is expected to bring in 1.26 million units in December, which combined with November’s results (1.12 million units), would equate to 2.37 million units, just shy of Xbox 360’s Call of Duty 4.

On a side note, by retail standards, the holiday season runs from October to December, but if we include September into the equation, Halo 3 would emerge as the best selling SKU with over 4.1 million units sold going into December.

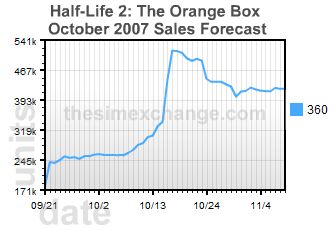

PS3 Half-Life 2 – PS3 Install Base Too Small

Back in October 2007, Half-Life 2: The Orange Box for the Xbox 360 sold 238,000 units. In December, we witnessed the release of its ported PS3 version. Typically, the consumer market dislikes staggered release dates as the last one to be released tend to post disappointing sales, likely due to less market buzz and media advertising. This theory holds true with the PS3 version of Half-Life 2: The Orange Box, which according to the prediction market is only expected to sell 103,000 units—an unsatisfactory figure. Also, a late release date was not the only factor as its first-person-shooter rival Call of Duty 4 likely cannibalized some of Half-Life 2: The Orange Box’s sales.

Arguments could be made that the Xbox 360 version of Half-Life 2: The Orange Box would sell better as it has a larger install base in the USA, but keep in mind that the Xbox 360 version was released in October, which only has 20% of the sales December will have.

For the holiday season, it appeared that the first person shooter market can only maintain two prosperous titles at any given time, for example on the Xbox 360, October was dominated by Half-Life 2: The Orange Box and Halo 3 while November/December were dominated by Call of Duty 4 and Halo 3. Unfortunately, the PS3 has such a small install base it is unable to successfully support two first-person-shooters in the same month. This theory will likely hold true for other great titles under the same genre with Uncharted: Drake’s Fortune and Ratchet & Clank Future: Tools of Destruction cannibalizing each other’s sales in December. This is evident in the prediction market’s expectations of Uncharted: Drake’s Fortune, which currently stands at only 142,000 units. Of course we do recognize that Uncharted and Ratchet & Clank are not technically in the same genre but given the PS3’s small install base, these two genres (action-combat and action-platform) tend to blend together in the eyes of consumers.

Long-term, we do not see this to be a major issue as most publishers/developers have learned their lesson and we will likely see more multi-platform simultaneous releases in the future. Also, with the growing PS3 install base, it will likely be able to support more than one successful title in the same genre by holiday 2008.

Timeshift –A Trifecta of Bad Circumstances

To extend further on the subject of staggered releases and cannibalization, Timeshift for the PS3 was released weeks after its PC and Xbox 360 counter-part. If a delayed release wasn’t bad enough, it was released in the same month of this year’s mega hit Call of Duty 4. What makes this a trifecta of bad circumstances was that the game was simply dreadful compared to the other first-person-shooters. This all equates to the lowest expectations for a title in December followed by the prediction market at only 33,000 units.

Publishers, Retailers, and Investors

Contact us below to find out how you can stay ahead of the competition by using some of our Industry Services.

Interview Requests

Both Jesse Divnich and Brian Shiau are available for interviews and direct comments from the media or the investment community. Please see this reports footnote for their contact information.

Media

This report and all forecasts on the simExchange Web site are available for your use. Please provide your readers context on the nature of these forecasts, for example: "The simExchange is an online virtual stock market in gamers, developers, and investors trade stock to predict how games will sell."

Jesse and Brian will offer quotes and/or analysis for your articles or any current event pertaining to the video game industry upon request. Any request should be made using the Contact Us form.

About The simExchange

The simExchange (www.thesimexchange.com) is the online prediction market for video games. Launched in November 2006, The simExchange allows thousands of gamers, developers, and industry watchers to forecast the video game industry. Participating in The simExchange is completely free and no real money is involved.

About Jesse Divnich

Jesse Divnich has been working in the video game industry for over 10 years. During that time he has assumed many professional roles including: beta tester, programmer, publisher analyst, and for the last 6 years, a private analyst and consultant for buy-side investment firms. Jesse Divnich has received many awards for his work in the private investment sector as an analyst covering publicly traded video game companies. Currently, Jesse Divnich has switched from the private sector to the public sector as an Analyst for The simExchange where he writes analytical articles on various industry topics.

Copyright and reprinting

The simExchange, LLC retains the right to the content of this article but permits the reprinting of this article with proper credit to The simExchange and Jesse Divnich.

The simExchange, LLC does not issue any investment ratings or investment recommendations for any publicly traded company. The accuracy of the opinions or data in this report is not a guarantee.

Permanent Link | Digg | del.icio.us | FacebookIndustry Review

Jesse Divnich

January 9, 2008

Key Points

- Industry Sales and GameStop Inc.

- Casual Gamers Taking Over

- American Publishers Struggle with Casual Games

- Spreading out AAA titles in 2008

- Price Points to Stay at a Premium

Introduction

This report is intended to aid industry professionals and the press in drawing insight and discovering trends occurring in the video game industry through the use of the simExchange video game prediction market (www.thesimexchange.com), a data aggregation system in which gamers, developers, and industry investors trade virtual video game stocks and futures to predict how video game products will sell and how they will be critically received.

Industry Sales and GameStop Inc.

Considering the prediction market's expectations for December software sales at $2.7 billion and past software sales numbers from the NPD Group for October and November, Fourth Quarter 2007 video game software sales are expected to ring in over $4.5 billion, a 55% increase over last year's $2.9 billion—an industry record.

Given this huge year-over-year increase, retailer GameStop is likely to shatter their own original internal estimate of only a 7% to 9% increase in comparable same store sales for their Fiscal Fourth Quarter (GameStop Inc. Form 8-k 11/20/2007). It should be noted that GameStop's FY Q4 runs from November 4 to February 3. Filling in those gaps with the prediction market's expectation of $592 million in sales for January, total video game software sales from November through January are expected to be $4.5 billion, a 49% increase over last year's $3.1 billion.

Retailers in general have had a rough holiday season with most posting dismal holiday figures, but given the explosive growth in the video game industry, we can expect GameStop to be one of the very few retailers to post flourishing figures this season.

One catalyst that played a factor for the industry's explosive growth is a larger than expected next generation adoption rate among casual gamers; unfortunately, this same catalyst has played only a minor role for GameStop stores.

Casual Gamers

Typically, casual gamers are the last group to purchase the next generation console systems as they prefer to wait for lower hardware prices before making an entry. This generation has broke the trend as casual gamers flocked to purchase the Nintendo Wii and Nintendo DS, which have positioned themselves in the market as the systems of choice among families, parents, seniors, and the other demographic groups that do not consider themselves avid gamers. Confirmation of this is observed in December 2007 sales as the Nintendo Wii is expected to sell over 1.8 million units and the DS to sell over 2.9 million units. Interesting enough, the DS selling over 2.9 million units would be an industry record for consoles or portables sold in one month. The current record is held by the PS2 at 2.6 million units in December 2002.

This influx in casual gamers can also be observed by the recent greater than expected performance of casual titles such as, Guitar Hero 3, Brain Age 2, and Wii Play, all of which are expected to exceed 9 million units in global lifetime sales (GLS), according to the prediction market. Even the upcoming Wii Fit is expected to achieve 8.73 million in GLS, putting it in same category as mega blockbusters as Halo 3 and PS3's Final Fantasy XIII, which are expected to achieve 9.1 and 7.8 million units in GLS, respectively. This rapid adoption rate among casual gamers is expected to continue in 2008 as hardware prices are reduced and video game companies expand their advertising campaigns to non-conventional media markets such as: television shows that target an older and female audience, family programming, and ironically, health magazines.

Based on the trends observed on the simExchange, we consider the casual market to be GameStop's biggest opportunity as the gap between their comparable store sales growth and that of the industry's total software sales growth is likely due to their lack of market penetration into casual/family sector.

"I agree with your assessment that GameStop has been a buying stop for more hard core gamers. I also think that their store environment is not inviting and is intimidating for the typical buyer of casual games, like mothers, non gamers etc. Another factor may be their inability to keep the popular games in stock. More casual buyers who shop at Wal-Mart, Target, Best Buy etc understand that those retail outlets carry larger volumes so there is a good chance a popular game will be in stock."

Ben Bajarin – Creative Stategies

American Publishers Struggle with Casual Games

By nature, casual games have a shorter development time, which lowers development costs and increases profit margins. To substantiate this, Guitar Hero had 3 releases and one add-on pack in the same timeframe it took Infinity Ward to produce and release one Call of Duty title (Call of Duty 4: Modern Warfare). To demonstrate the magnitude of the success of the Guitar Hero franchise, to date it has sold over 9.5 million units in the United States (data provided by The NPD Group). Guitar Hero 3 alone is expected by the simExchange to sell 8.2 million units in GLS; Call of Duty 4, 7.5 million in GLS.

Although publishers such as Nintendo have had tremendous success with this genre, it is a different story for the American publishers whose successes in the genre in recent years consist of two main franchises, The Sims and Guitar Hero. It is lucid that the American publishers have had a difficult time tapping into the casual and family market. What has made it difficult is their lack of understanding of the casual and family market, something Nintendo has clearly mastered. The prediction market supports this as the top 5 titles for both the Wii and the DS consist of 9 Nintendo published titles and no American published titles.

Top Titles in expected Global Lifetime Sales -

Nintendo DS

Rank Title Expected units 1 Pokemon Diamond / Pearl (DS) 17.13 million 2 Brain Age 2 9.2 million 3 Dragon Quest IX (DS) 6.71 million 4 The Legend of Zelda: Phantom Hourglass 4.27 million 5 Mario Party DS 3.04 million

-

Nintendo Wii

Rank Title Expected units 1 Wii Play (Wii) 14.21 million 2 Super Smash Bros Brawl (Wii) 13.95 million 3 Mario Kart (Wii) 13.16 million 4 Super Mario Galaxy (Wii) 12.61 million 5 Wii Fit (Wii) 8.73 million Although the American publishers will still experience growth as the core gaming market grows, penetrating the casual market will provide the largest growth. To be successful, the American publishers must venture beyond the status quo of game design and start exploring these unconventional genres--something Nintendo has had astonishing success.

"Publisher's were largely caught off-guard by the runaway success of the Wii. As a result they are late to the table with developing titles, choosing to port PS2 titles, and thus make measuring their performance difficult. The more challenging aspect for publishers will be adapting their development teams and franchises to be better suited to the platform."

Dave Moreno - NeoGAF LLC.

Spreading out AAA titles in 2008

Hardcore gamers in 2007 complained about the congestion of AAA titles released in the back half of the year, which resulted in cannibalization of sales of some of the year's best titles. The simExchange had predicted this tradeoff in sales between competing titles. This phenomenon likely affected industry decision makers as 2008 is looking to be a more spread out year for blockbuster titles.

Before the first half of 2008 ends, we can expect the release of AAA titles such as Super Smash Bros. Brawl (expected to achieve 13.95 million units of GLS), Wii Fit (expecting 8.7 million units of GLS), Grand Theft Auto IV (expecting 17 million units of GLS), and Metal Gear Solid 4 (expecting 4.7 million units of GLS).

Short-term economic factors can make any period of the year riskier for introducing new products, a phenomenon investors have experienced across the retail sector in Q4 2007. A broader release schedule could positively affect retailers such as GameStop and make them more attractive to the investment community as they will have more months of strong sales to hedge themselves against any negative short-term economic factors.

Price Points to Stay at a Premium

Since the inception of the next generation systems, it has been debated how long the new premium price points can hold. Given the expected 55% sales increase this holiday season and the slew of top rated titles in 2008, it is most probable that the current price points for premium games on their respected systems will remain unchanged. This will add another benefit to GameStop in 2008 as retail profits are not based on a fixed price, but instead a fixed margin percentage—around 20%. Additionally, as the current shift from the legacy systems to the current generation continues, there will be a higher ratio of games sold at the $59.99 premium price to legacy games sold in 2008. This will equate to a higher "average price per game" in 2008; in retail terms it is often called "average dollars per transaction".

"I think that the $60 price point not only will hold, but I think that publishers will continue to test higher price points during the year. In 2007, we saw Halo 3 collector's editions at $100 (or more), Guitar Hero at $100, Rock Band at $170. This year, we'll see the Grand Theft Auto bundle at $80 or $90, and will likely see a new offering from Guitar Hero with other instruments. I think you'll see a bunch of collector's edition games, and think that PS3 and 360 premium content will all debut at $60."

Michael Pachter – Wedbush Morgan

Publishers, Retailers, and Investors

Contact us below to find out how you can stay ahead of the competition by using some of our Industry Services.

Interview Requests

Both Jesse Divnich and Brian Shiau are available for interviews and direct comments from the media or the investment community. Please see this reports footnote for their contact information.

Media

This report and all forecasts on the simExchange Web site are available for your use. Please provide your readers context on the nature of these forecasts, for example: "The simExchange is an online virtual stock market in gamers, developers, and investors trade stock to predict how games will sell."

Jesse and Brian will offer quotes and/or analysis for your articles or any current event pertaining to the video game industry upon request. Any request should be made using the Contact Us form.

About The simExchange

The simExchange (www.thesimexchange.com) is the online prediction market for video games. Launched in November 2006, The simExchange allows thousands of gamers, developers, and industry watchers to forecast the video game industry. Participating in The simExchange is completely free and no real money is involved.

About Jesse Divnich

Jesse Divnich has been working in the video game industry for over 10 years. During that time he has assumed many professional roles including: beta tester, programmer, publisher analyst, and for the last 6 years, a private analyst and consultant for buy-side investment firms. Jesse Divnich has received many awards for his work in the private investment sector as an analyst covering publicly traded video game companies. Currently, Jesse Divnich has switched from the private sector to the public sector as an Analyst for The simExchange where he writes analytical articles on various industry topics.

Copyright and reprinting

The simExchange, LLC retains the right to the content of this article but permits the reprinting of this article with proper credit to The simExchange and Jesse Divnich.

The simExchange, LLC does not issue any investment ratings or investment recommendations for any publicly traded company. The accuracy of the opinions or data in this report is not a guarantee.

Permanent Link | Digg | del.icio.us | FacebookNovember Review Report

Jesse Divnich

December 14, 2007

Key Points

- Video games break sales records

- Call of Duty 4 – #1 in November

- Rock Band Carries a Tune

- Assassin’s Creed Smashes Expectations

- Manhunt 2 Misses its Mark

- Crysis trumps Unreal Tournament 3

Introduction

This report is intended to aid industry professionals and the press in drawing insight and discovering trends occurring in the video game industry through the use of the simExchange video game prediction market (www.thesimexchange.com), a data aggregation system in which gamers, developers, and industry investors trade virtual video game stocks and futures to predict how video game products will sell and how they will be critically received.

Results based on NPD data have consistently shown that The simExchange prediction market can predict results not only more accurately than traditional models and surveys, but also more quickly adjust forecasts based on industry and product news.

Hardware Market Share

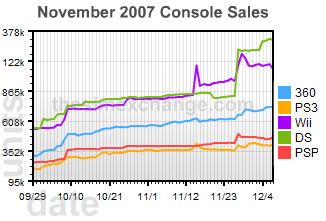

Hardware market share rankings in November came in-line with expectations, but unit sales results were all well above the market’s expectations. The only exception was the

Nintendo Wii, which missed the 1,060,000 units forecasts by the prediction market. Nintendo’s claims of supply constraints likely played a bigger role in hindering sales than originally expected. The PS3 sold better than expected against its closest rival, the Xbox 360, which only outsold it by 1.6-to-1 from an expected 1.8-to-1. Sony’s recent price cut and introduction of a cheaper 40GB model played a significant role in closing the gap between its console and the Xbox 360.

Record Software Sales

November’s software sales rang in an amazing $1.3 billion dollars, a 62% increase year-over-year, which set an industry record for software sales in November. December is still expected by the prediction market to amount to $2.4 billion in software sales, another record-breaking month. Given the NPD Group’s October and November data and the simExchange’s December projections, retailers are expected to bring in $4.2 billion in software sales this quarter, a 44% increase year-over-year--also an industry record for software sales.

Many industry observers were concerned that the slowing US economy and slower Holiday shopping this year would dampen game sales, which explains conservative forecasts across the board. Data released by the NPD Group indicates that the pessimism was unwarranted. These results will have a positive impact on retailers like GameStop whose revenue depends heavily on the video game sector.

Call of Duty 4 – #1 in November

Originally, Super Mario Galaxy was expected to be the number one selling SKU in November at 1.2 million units. However, to the market’s surprise, Call of Duty 4 for the Xbox 360 reigned king at over 1.5 million units sold in November versus Super Mario Galaxy’s 1.1 million units. Call of Duty’s success was driven not by its single player but likely by its addicting online play, which mashes the First-Person-Shooter modern war style of play with a deep RPG and stat tracking element—clearly a recipe for success.

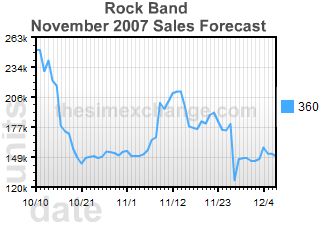

Rock Band Carries a Tune

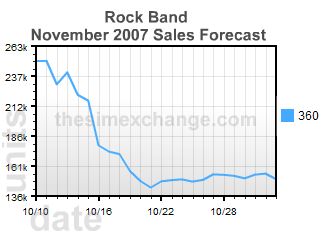

Rock Band, up against an improperly executed marketing campaign, supply constraints, and hardware bugs, still managed to beat market expectations by ringing in 311,909 units sold in November, well above the market’s expectation of 152,000 units. We consider this a significant achievement for Harmonix, which despite large barriers managed to break into the music peripheral genre under a new intellectual property, which clearly could have been marketed better to consumers.

Assassin’s Creed Smashes Expectations

Despite mixed reviews and some early controversy, Ubisoft was able to overcome these barriers by executing a fantastic marketing campaign that drove unit sales well above market expectations at 980,000 and 376,483 units for the Xbox 360 and the PS3, respectively. This proves once again that marketing, advertising, and public relations play the biggest factor to any new intellectual property.

Manhunt 2 Misses its Mark

Manhunt 2 was released to the market with great concerns over its content as activist groups and parents claimed the Wii remote control added too much realism to an already violent game. These concerns with Take-Two, the ESRB, and retailers have proven to be unnecessary as sales were a depressing 18,494 units sold in November—making little impact on the industry. This should not be considered a victory for those groups who protested its release, but rather a victory for industry and gamers who did not fall for the market hype of what can only be described as a poorly executed title.

Crysis trumps Unreal Tournament 3

Originally, the market expected Unreal Tournament 3 to surpass Crysis; however, this was proven to be false as Crysis triumphed over Unreal with 86,633 to 33,995 units, respectively. It should be noted that even though Crysis beat market expectations, it is far from being called a success, and still suggests that the best PC titles are those that can be readily available to a wider market by having lower hardware requirements.

-

US Hardware in November 2007

Title Actual units Expected units % From Expected Nintendo Wii 981,000 1,085,500 -9.63% Nintendo DS 1,535,000 1,297,700 +18.29% Xbox 360 770,000 753,200 +2.23% PlayStation Portable 567,000 497,900 +13.88% PLAYSTATION 3 466,000 424,400 +9.80% Total Hardware Units 4,319,000 4,058,700 +6.41%

-

US Software in November 2007

Rank Title Actual units Expected units % From Expected 1 Call of Duty 4 (Xbox 360) 1,565,404 840,000 +86.36% 2 Super Mario Galaxy (Wii) 1,123,070 1,304,800 -13.93% 3 Assassin's Creed (Xbox 360) 980,000 -- -- 4 Guitar Hero III: Legends of Rock (PS2) 967,000 -- -- 5 Wii Play (Wii) 564,000 -- -- 6 Mass Effect (Xbox 360) 472,793 395,400 +19.57% 7 Call of Duty 4 (PS3) 444,000 -- -- 8 Guitar Hero III: Legends of Rock (Wii) 426,000 -- -- 9 Halo 3 (Xbox 360) 387,000 -- -- 10 Assassin's Creed (PS3) 376,843 272,300 +38.38% NR Mario & Sonic at the Olympic Games (Wii) 328,314 246,600 +33.13% NR Rock Band (Xbox 360) 311,903 147,900 +110.89% NR Crysis (PC) 86,633 68,600 +26.28% NR Unreal Tournament 3 (PC) 33,995 70,600 -51.84% NR Manhunt 2 (Wii) 18,494 47,100 -60.74% Total Tracked Software Units 4,317,390 3,483,300 +23.95% Total Software Sales $1.3 billion $1.16 billion +12.07% Publishers, Retailers, and Investors

Contact us below to find out how you can stay ahead of the competition by using some of our Industry Services.

Interview Requests

Both Jesse Divnich and Brian Shiau are available for interviews and direct comments from the media or the investment community. Please see this reports footnote for their contact information.

Media

This report and all forecasts on the simExchange Web site are available for your use. Please provide your readers context on the nature of these forecasts, for example: "The simExchange is an online virtual stock market in gamers, developers, and investors trade stock to predict how games will sell."

Jesse and Brian will offer quotes and/or analysis for your articles or any current event pertaining to the video game industry upon request. Any request should be made using the Contact Us form.

About The simExchange

The simExchange (www.thesimexchange.com) is the online prediction market for video games. Launched in November 2006, The simExchange allows thousands of gamers, developers, and industry watchers to forecast the video game industry. Participating in The simExchange is completely free and no real money is involved.

About Jesse Divnich

Jesse Divnich has been working in the video game industry for over 10 years. During that time he has assumed many professional roles including: beta tester, programmer, publisher analyst, and for the last 6 years, a private analyst and consultant for buy-side investment firms. Jesse Divnich has received many awards for his work in the private investment sector as an analyst covering publicly traded video game companies. Currently, Jesse Divnich has switched from the private sector to the public sector as an Analyst for The simExchange where he writes analytical articles on various industry topics.

Copyright and reprinting

The simExchange, LLC retains the right to the content of this article but permits the reprinting of this article with proper credit to The simExchange and Jesse Divnich.

The simExchange, LLC does not issue any investment ratings or investment recommendations for any publicly traded company. The accuracy of the opinions or data in this report is not a guarantee.

Permanent Link | Digg | del.icio.us | FacebookNovember Preview Report

Jesse Divnich

December 10, 2007

Key Points

- Video games to break record sales

- PC Games continue to cannibalize each other

- Assassin's Creed - the woes of new intellectual property

- Rock Band - Too many hands in the cookie jar

- Wii - Can it handle M-rated titles

This report is intended to aid industry professionals and the press in drawing insight and discovering trends occurring in the video game industry through the use of the simExchange video game prediction market (www.thesimexchange.com), a data aggregation system in which gamers, developers, and industry investors trade virtual video game stocks and futures to predict how video game products will sell and how they will be critically received.

Results based on NPD data have consistently shown that The simExchange prediction market can predict results not only more accurately than traditional models and surveys, but also more quickly adjust forecasts based on industry and product news.

The simExchange's Market Predictions

-

US Hardware in November 2007

Title Predicted unit sales Xbox 360 728,000 units PLAYSTATION 3 410,000 units Wii 1,060,000 units Nintendo DS 1,300,000 units PlayStation Portable 468,000 units

-

US Software in November 2007

Title Predicted unit sales Assassin's Creed (PS3) 272,000 units Call of Duty 4: Modern Warfare (Xbox 360) 833,000 units Crysis (PC) 66,000 units Manhunt 2 (Wii) 46,000 units Mario & Sonic at the Olympic Games (Wii) 242,000 units Mass Effect (Xbox 360) 328,000 units Rock Band (Xbox 360) 152,000 units Super Mario Galaxy (Wii) 1,270,000 units Unreal Tournament 3 (PC) 78,000 units Hardware Sales

Continuing the trend over the last 6 months, the Wii is expected top the console charts with 1,060,000 units according to the trading on the prediction market. The Xbox 360, a close second, is forecast to sell 728,000 units, while at a distant third, again, is the PS3 at 410,000 units. On the portable side, the trend persists with the Nintendo DS selling 1,300,000 units and the PSP selling 468,000 units, according to the prediction market.

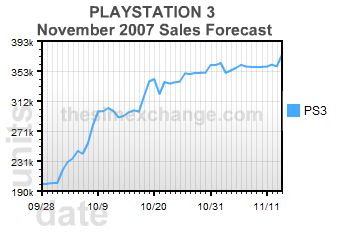

Consistently a distant third, the PS3 is beginning to close the gap with its closest rival, as the Xbox 360 is only expected to out sell the PS3 1.8-to-1 in November compared in to 3-to-1 in October. The prediction market upgraded the PS3 forecast after the initial reception of the new 40GB PS3 model and recent press releases indicating a strong Thanksgiving weekend.

Despite increasing PS3 sales, we do not expect any significant shift in PS3 market share in Sony’s favor until mid 2008. A shift will likely be the result of continued hardware price cuts and the release of several AAA titles such as Metal Gear Solid 4 and Grand Theft Auto IV—both of which is expected to be released near the half-way point of 2008. The PS3 is expected to gain market share as the prediction market is still expecting a close race in global lifetime sales with current expectations of 58 million units and 54 million units for the Xbox 360 and the PS3, respectively.

Record Software Sales

The prediction market expects November’s software sales to be $1.15 billion which is a 42% increase over sales last year. These sales were driven by the continued success of Guitar Hero 3, Halo 3, and Zelda: Phantom Hourglass along with newly released titles such as Assassin’s Creed, Call of Duty 4, Mass Effect, Need for Speed, Super Mario Galaxy, and WWE Smackdown vs. Raw 2008. The prediction market’s forecast on software sales will be the highest ever seen in the month of November and the first time November sales will break $1 billion.

Not to be outdone, December sales are expected by the prediction market to ring in $2.39 billion, which is a 38% increase year-over-year, another record-breaking month. Combining The NPD Group’s estimates in October, retailers will net over $4.04 billion in software sales this holiday quarter, a 39% increase year-over-year—a record as well.

Although consumer spending has slowed down this quarter with many retailers reporting disappointing results, video games are largely inelastic to consumer income. The market’s forecast for November and December confirms the belief that video games are a safe haven business in slower consumer spending environments.

PC Games – Continued Cannibalization

PC games have long been considered the pioneer in industry gaming, always pushing the envelope in graphics and online play. Unfortunately, this year has seen a slew of highly anticipated first-person shooter titles packed into the back half of the year. This resulted in sales cannibalization as witnessed last month by poor sales of Enemy Territory: Quake Wars due to competition from Half-Life 2, and anticipation for Call of Duty 4, Crysis, and Unreal Tournament 3.

A similar phenomenon is occurring in November. The prediction market is only expecting 66,000 units and 78,000 units sold for Crysis and Unreal Tournament 3, respectively. The prediction market likely expects Unreal Tournament 3 to outsell Crysis due to Crysis’ high hardware requirements. In terms of PC game sales, superior game play still remains the strongest lure to consumers; consequently, high powered graphics play an adverse role on PC games sales. Counter-Strike, Everquest, World of Warcraft, and the recent Half-Life 2: Orange Box are examples of this decades biggest PC titles which, achieved worldwide success due to their compelling game play and low hardware requirements.

Conversely, Crysis was more popular among web users as it achieved a higher “average daily gamers” metrics in November on IGN GamerMetrics*: 24,588 to Unreal Tournament 3’s 17,633. Although gamers enjoyed viewing the videos and screenshots Crysis had to offer, the prediction market’s projections suggest that few had the hardware power to purchase Crysis. For reference, the game with the highest “average daily gamers” metric on IGN GamerMetrics for November was Mass Effect with an average of over 64,000 daily visits.

* Data used with express written consent by IGN GamerMetrics.

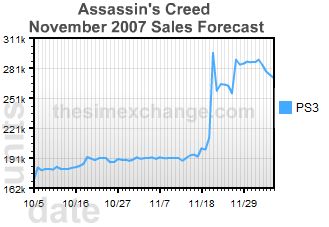

Assassin's Creed – The woes of a new Intellectual Property

The prediction market has been expecting Ubisoft's Assassins Creed to be one of the highest anticipated titles of the year. A month before the game’s release, the prediction market expected the PS3 version of Assassin's Creed to sell in the 200,000 unit range. These relatively low expectations for such a highly anticipated title were likely due to concerns with the game’s quality as critics and bloggers released mixed previews. This trend persisted through the first week of release as reviewers poured mixed reviews to consumers.

Sales expectations began to rise as Ubisoft kicked up its marketing efforts online, in print, and on television, resulting in a large increase in projected sales to the current estimate of 272,00 0 unit for the PS3 version. These projections are reinforced by data available from GameTrailers.com*, which tracks “Media Views” a metric for the number of visitors that view a Publisher-produced or GameTrailers-produced video.

Between November 11, 2007 and December 2, 2007, Assassin’s Creed received 3,029,950 Media Views—the highest score for any game during that time period. Just for comparison, the second ranked title was Mass Effect at only 1,490,606 Media Views.

Despite mixed reviews, Assassin’s Creed was able to penetrate the mainstream market by delivering an effective but costly marketing campaign. This is common as large marketing budgets are often needed to jump-start new properties as brand awareness and market credibility are low. This is often risky for publishers as they bear all the risk by sinking funds into a marketing budget for an un-established title. This is why publishers prefer sequels and recycled yearly titles as marketing an established game have fewer costs.

* Data used with express written consent by GameTrailers.com

Rock Band – Too many hands in the cookie jar

Rock Band is a great example of what can go wrong when too many people are involved in marketing a product. The poor execution and communication has made this the most volatile NPD Future in November. Originally, the prediction market expected Rock Band to sell over 200,000 units in November, but that forecast quickly dropped to 145,00 units as news broke that a $169 bundle would be the only version available for 2007. Days later, Harmonix reversed Electronic Arts’ statement and announced that an unbundled version will be available in 2007. This reversal lead to an upgraded forecast by the prediction market.

Price swings continued as Electronic Arts announced Rock Band would be in short supply, a tactic often used by hardware manufacturers to pump up demand. The market than slowly cut forecasts after the game’s release as bloggers commented that not only was retail supply plentiful, but consumers were having problems with third-party guitars. The current projection for November is 152,000 units for the Xbox 360.

Prediction markets are most commonly used as a tool for forecasting, but they can also enable us to track the public’s perception of a game’s business strategies in terms of marketing, advertising, and public relations. Rock Band is an example of what can happen when three different companies (Harmonix, MTV, and Electronic Arts) attempt to simultaneously market the same product.

Manhunt 2 – Can the Wii Handle “M” and Can American Publishers Succeed

American publishers and Nintendo have had a bumpy relationship over the last few years as American publishers have continued to fail to gain any traction on Nintendo’s consoles. This was prevalent on the legacy system Nintendo Gamecube, but was never considered a serious issue by investors as the Gamecube’s market share was not significant. This generation, Nintendo has turned the tides as it now dominates both the home console and the handheld market.

The increasing significance of Nintendo platforms is a growing concern as American publishers have had little success on the Nintendo Wii in 2007; the exception to that rule would be Activision’s Guitar Hero III. Manhunt 2 for the Wii could serve as a significant example for the future success of not only “M” rated games on the Wii but how well American publishers are taking advantage of the Wii’s vast consumer base.

Originally, the prediction market expected Manhunt 2 sales to surpass 120,000 units, but as the release date for the game approached, the prediction market began pricing in Manhunt 2’s quality pitfalls. the game’s currently expected sales of 46,000 units for November is far below the market’s original expectation. The problems with the Manhunt 2 appear to be specific to the title and not the Wii market and so it should not be considered as any type of barometer for how an M-rated game can succeed on the Nintendo Wii. It has been said in the past that Wii consumers prefer originality over conformity, innovation over similarity, and more importantly, titles that are just simply fun to play. Manhunt 2 is innovative and its control scheme keeps it original; however, it just lacks one crucial element—it’s not fun.

Publishers, Retailers, and Investors

Contact us below to find out how you can stay ahead of the competition by using some of our Industry Services.

Interview Requests

Both Jesse Divnich and Brian Shiau are available for interviews and direct comments from the media or the investment community. Please see this reports footnote for their contact information.

Media

This report and all forecasts on the simExchange Web site are available for your use. Please provide your readers context on the nature of these forecasts, for example: "The simExchange is an online virtual stock market in gamers, developers, and investors trade stock to predict how games will sell."

Jesse and Brian will offer quotes and/or analysis for your articles or any current event pertaining to the video game industry upon request. Any request should be made using the Contact Us form.

About The simExchange

The simExchange (www.thesimexchange.com) is the online prediction market for video games. Launched in November 2006, The simExchange allows thousands of gamers, developers, and industry watchers to forecast the video game industry. Participating in The simExchange is completely free and no real money is involved.

About Jesse Divnich

Jesse Divnich has been working in the video game industry for over 10 years. During that time he has assumed many professional roles including: beta tester, programmer, publisher analyst, and for the last 6 years, a private analyst and consultant for buy-side investment firms. Jesse Divnich has received many awards for his work in the private investment sector as an analyst covering publicly traded video game companies. Currently, Jesse Divnich has switched from the private sector to the public sector as an Analyst for The simExchange where he writes analytical articles on various industry topics.

Copyright and reprinting

The simExchange, LLC retains the right to the content of this article but permits the reprinting of this article with proper credit to The simExchange and Jesse Divnich.

The simExchange, LLC does not issue any investment ratings or investment recommendations for any publicly traded company. The accuracy of the opinions or data in this report is not a guarantee.

Permanent Link | Digg | del.icio.us | FacebookOctober Review Report

Jesse Divnich

November 15, 2007

Key Points

- Hardware market share is consistent with previous forecast

- 40GB PS3 Model expected to increase sales in November and December

- Software sales expectations

- Activision's success and self-cannibalization

- Sony continues to struggle with its PS3 exclusives

- Assassin's Creed impacted by mixed reviews

Introduction

This report is intended to aid industry professionals and the press in drawing insight and discovering trends occurring in the video game industry through the use of the simExchange video game prediction market (www.thesimexchange.com), a data aggregation system in which gamers, developers, and industry investors trade virtual video game stocks and futures to predict how video game products will sell and how they will be critically received.

Results based on NPD data have consistently shown that The simExchange prediction market can predict results not only more accurately than traditional models and surveys, but also more quickly adjust forecasts based on industry and product news.

-

Exclusive figures provided b NPD - October 2007

Title Predicted unit sales Enemy Territory: Quake Wars (PC) 412,000 units Final Fantasy Tactics: The War of The Lions (PSP) 136,000 units Project Gotham Racing 4 (Xbox 360) 38,300 units Ratchet & Clank Future: Tools of Destruction (PS3) 74,500 units Hardware Market Share

Hardware sales were in line with market expectations with total unit sales just 0.57% above market expectations. As predicted, the Wii took back the top spot, which it lost to the Xbox 360 last month due to the Halo 3 launch. The market share break down for consoles matched previous market predictions. Most notably for hardware sales, the PS3 continues to lag the home console sector with only 121,000 units in October, 19% below market expectations.

The prediction market is forecasting the current market share break down to persist in November and December. Nintendo Wii will continue to lead the home console category; Nintendo DS the portable category. Listed below are the hardware expectations for November and December:

-

US Hardware in November 2007

Title Predicted unit sales Wii 912,000 units Xbox 360 636,000 units PLAYSTATION 3 458,000 units Nintendo DS 844,000 units PlayStation Portable 398,000 units

-

US Hardware in December 2007

Title Predicted unit sales Wii 2,370,000 units Xbox 360 1,560,000 units PLAYSTATION 3 695,000 units Nintendo DS 2,020,000 units PlayStation Portable 842,000 units

PS3 40GB Model

Sony recently announced a successful launch of its new PS3 40GB model. The prediction market reacted quickly to this news and continued to increase its expectations for the PS3 in November to 458,000 units from a prior 292,000 units before the new model announcement.

Although the grass may look greener on the other side, the market still questions Sony’s ability to generate strong first-party sales—a key factor to any console’s success. Ratchet & Clank Future only sold 74,500 units in October, well below an already low market expectation of 129,000 units. Sony does have one last chance to prove itself in 2007 with its first-party titles with Uncharted: Drake’s Fortune, which the prediction market expects 286,000 units sold in December.

Software Sales

Software sales came under expectations at $513.9 million units but still an outstanding 39% increase over last year. The prediction market has demonstrated great accuracy in software sale estimates, expecting just a 7% difference in October. The market is expecting November and December to produce $1.05 billion and $2.19 billion in sales, a 31% and 27% increase year-over-year, respectively. Both November and December estimates would both be industry records.